When it comes to investment strategies, there are various reasons why “fast growth” and “dividend income” are often considered to be polar opposites.

After all, rapidly growing firms generally channel cash into expansion rather than paying it back to shareholders. And for income-hunting investors, the most dependable dividends are routinely found among predictable but slow-growing large-caps. But is there a happy medium for those looking for the best of both worlds? It turns out there can be.

Back in the early 1990s, the late City businessman Jim Slater, wrote an investment guide called the The Zulu Principle in which he described his strategy of buying fast growing companies trading at reasonable prices. In assessing the investment case of a share, he saw dividends as an important marker. He wrote:

“I prefer companies to pay a dividend, as most institutions need an income stream from their investments. Also, the dividend payment and forecast (if any) to some extent corroborate the management’s confidence in the future. The ideal company will have a steadily increasing dividend growing broadly in line with earnings.”

For Slater, dividend payouts were a sign of management confidence and the expectation that earnings would continue to grow. He wanted to see earnings and dividend growth to go hand in hand.

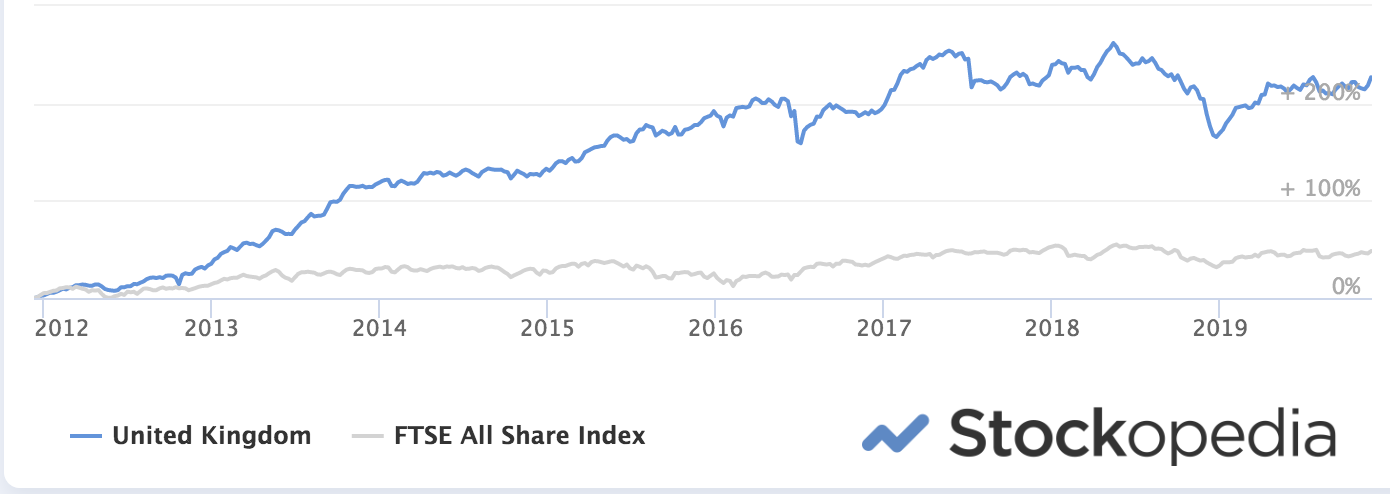

A combination of growth and income might sound like some unlikely ideal, but stocks that fit this profile have actually enjoyed periods of very strong performance over the past eight years. Of all the investment models tracked by Stockopedia, one of the standout performers this decade is called Winning Growth & Income.

This strategy had a particularly strong run between 2012 and 2017. Overall, it’s has produced a theoretical cumulative return of 222 percent (pre-costs and excluding dividends) since we started tracking it in late 2011. It pulled back sharply in 2018, but there are signs now that it has started to stabilise. Just as importantly, the numbers of companies passing the strategy rules is starting to grow.

What makes growth and income a winning strategy?

The consistency of Winning Growth & Income is down to a simple set of rules that touch on three influential drivers of returns - Quality, Value and Momentum, with the important added bonus of above-average yield. It’s a strategy inspired by work by US investment analyst Kevin Matras in his book, Finding #1 Stocks.

In…