Not exactly bored but a little bit of spare time.

This has been on my to do list for a while and it's based on the 100 Baggers book Christopher Mayer, a great read.

Anyway, by keeping it really simple to start with, here's the draft screen, which throws up just 42 shares, which is not a bad base in my opinion.

NOTE: I've opted for 10 as a filter in many cases as just seems reasonable.

So, let's see if we can come up with a screen, I'm sure we can!

1 - PEG less than 1 - Basically means it's earnings are growing faster than the current PE - Peter Lynch also likes this measure.

2 - (Current) Mkt Cap > £20m and (Current) Mkt Cap < £500 - Just seems to make sense.

3 - EPS Growth % (this year) > 10 - Make sure it's earnings are growing at a decent rate.

4 - (Current) ROCE % > 10 - Make sure it's making a decent return on Captial.

5 - (Current) PE > 10 - Make sure the market likes it.

Observations...

A - Of the 42 shares just 6 have a Stock Rank less than 50 - Could perhaps add Stock Rank > 49 for example.

B - Adding Sales Growth % (this year) > 10 - Reduces the list to 35.

C - Adding Operating Profit Growth % (this year) > 10 - Reduces the list even further to a very manageable 30 (which still includes 4 shares with a Stock Rank less than 50). Exclude those and we're looking at just 26 shares.

Where now...

Would love input on this - Of course this is very basic and roughly based on the findings of the book - But even though it's basic, it does quite well to get the list down to 30/26 shares.

So from those 30/26 the job would be to find those with a decent moat with the prospect of becoming 100 baggers in the next, all being well, 10 years or so!

Hopefully I am able to share the screen - Here it is - If not, it's not hard to recreate.

Thanks in advance!

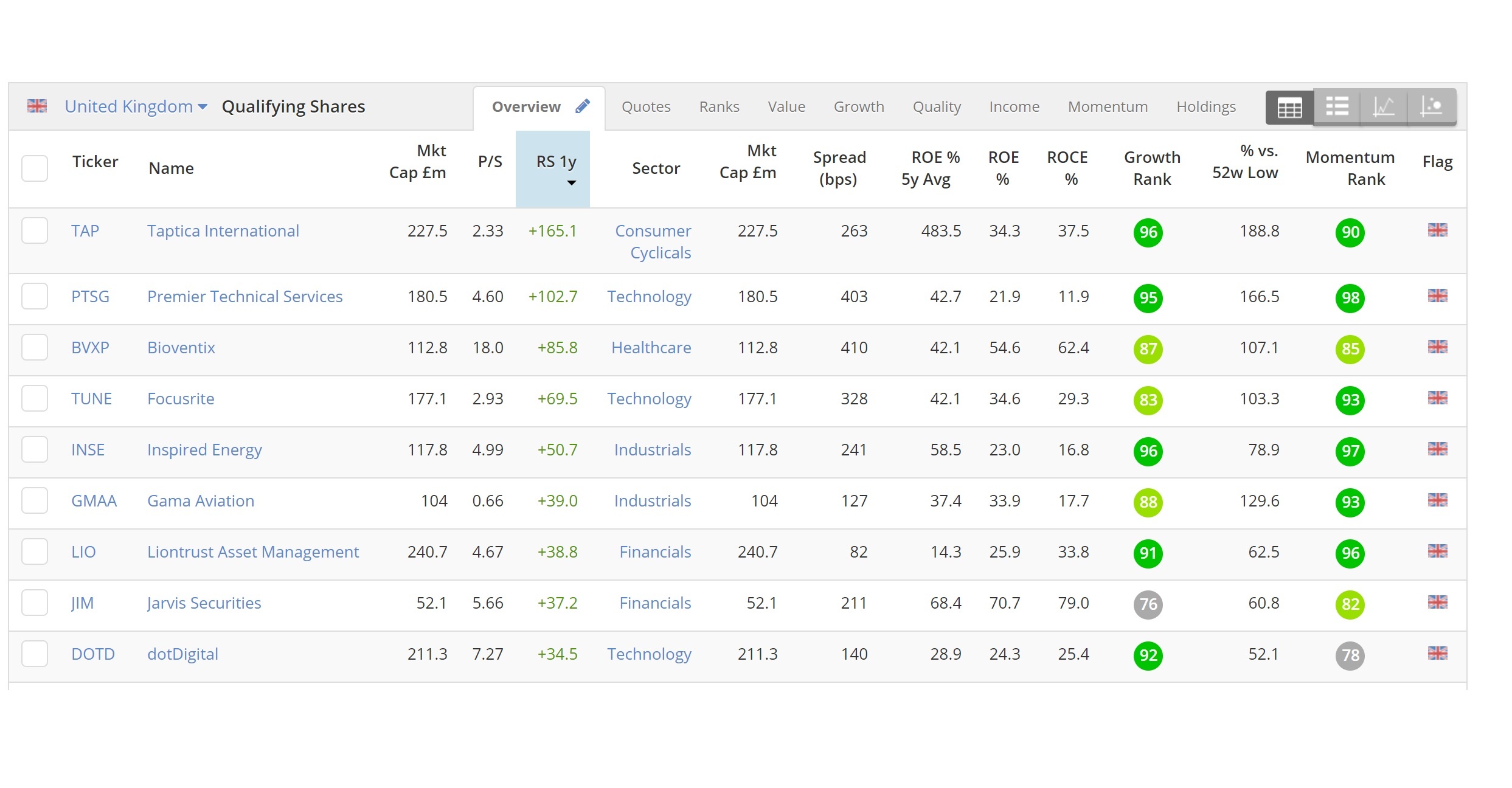

ps - Attached is a screen shot of the 13 qualifying with a Stock Rank > 80 - What's your 100 bagger pick from that lot?

…