Shareholders in JD Sports (LSE: JD) are pleased with the reward for buying and holding this stock. If you ignore dividends, capital appreciation gains are 1,584% in the last decade. (i.e. Invest £10,000 and it turns into £158,400!) And the unique selling point of JD? It distributes brands sportswear and acquired failing outdoor and sportswear brands.

JD Sports not that Special

I’m not cussing JD Sports and its success. The gains delivered to shareholders is a dream that other companies can only fantasize. But, there is nothing special about JD Sports (I mean the standalone brand).

What do I mean?

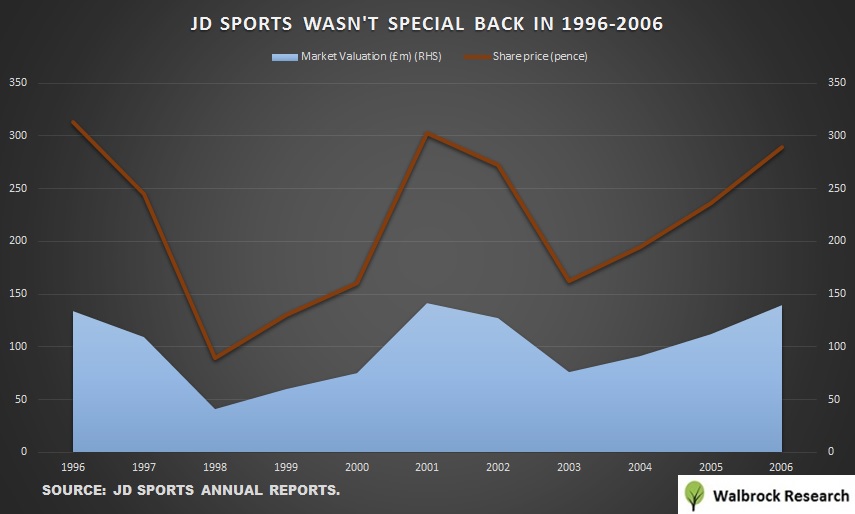

Prior, to the colossal gains between 2007 and 2017, the previous decade before that, its market performance was mediocre.

GRAPH 1

(Click here for larger image.)

The market valuation of JD in the beginning of 1996 was £134m and ended 2006 with a market value of £139m. In share price terms, you would have lost 8% of your initial capital.

So, what has transformed JD Sports into the powerhouse that it is today?

Here are 12 facts that contribute to making the king of selling trainers great.

12 THINGS

THAT GOT JD SPORTS SHAREHOLDERS 1,584% GAINS

WORKOUT FACT 1: RISING PROFITS AND INCREASING MARGINS

GRAPH 2

(Click here for larger image.)

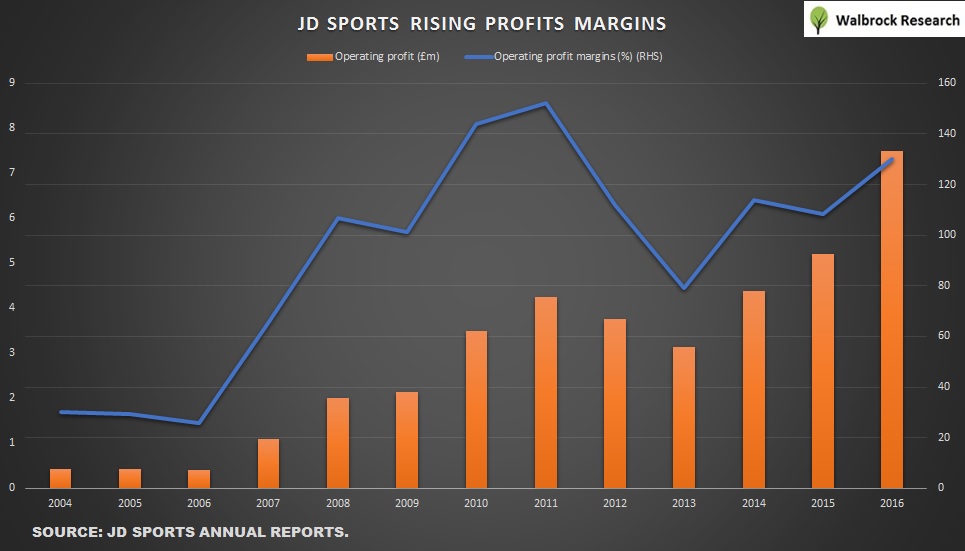

Notice the first three years, JD barely earns £8m per year, and operating margins was a small 1.5%. From 2007 onwards, other sports retailers begun to unravel. JD started to see improvement in margins and absolute profits.

In fact, operating profits is £133m by 2016, a 1,900% increase from 2004.

WORKOUT FACT 2: JD SPORTS WIDE-RANGING BRANDS

COLLECTION

Apart from the above brand logos, JD, also owned Chausports, Splinter, Kooga, Kukri, Get The Label, Focus, Source Lab, Tessuti, Cloggs, Nicholas Deakins, Mainline, Blacks, Millets, Tiso and Ultimate Outdoors.

That is a lot of brands and extra store fronts under JD’s portfolio. Also, by taking over these brands, JD lessen the competition and boost margins.

I won’t go into details why acquisitions makes JD stronger because I will do a separate article. (So, watch this space)

WORKOUT FACT 3: SUPREME PROFITABILITY RATIOS

GRAPH 3

(Click here for larger image.)

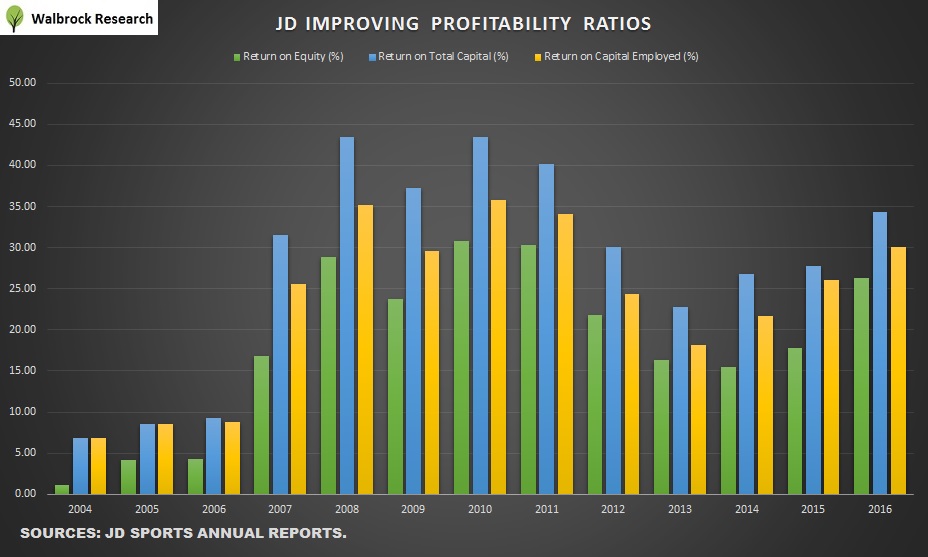

The improvement in JD’s profitability ratios played a part in increasing…