For my contributions to the 12 Stocks of Christmas, I am choosing four stocks that epitomise Quality, Value, Momentum and Growth for me. Yesterday, it was Value; today, it is Quality.

On the 9th Day of Christmas, my true love gave to me:

Billington Holdings (LON:BILN)

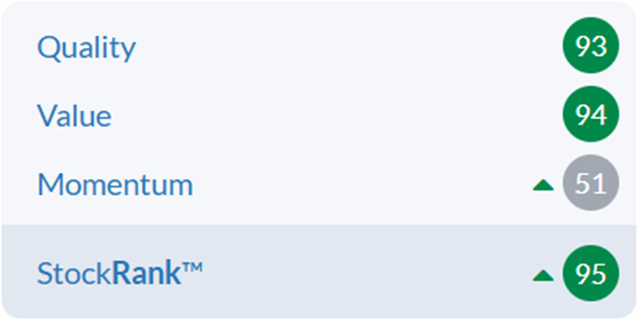

Billington has an impressive 93 Quality Rank:

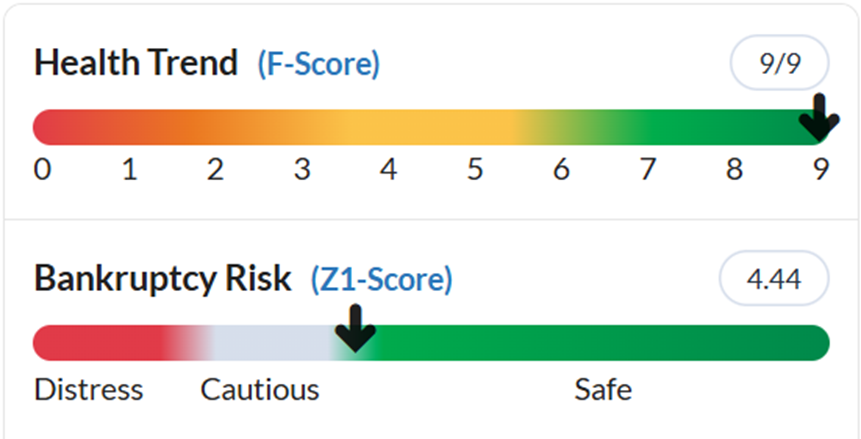

This is partially due to its 9/9 for Piotroski score and bulletproof balance sheet:

The Beneish score flags this as a potential earnings manipulator. However, having looked at the accounting details, I don’t believe this is a company that has manipulated their earnings.

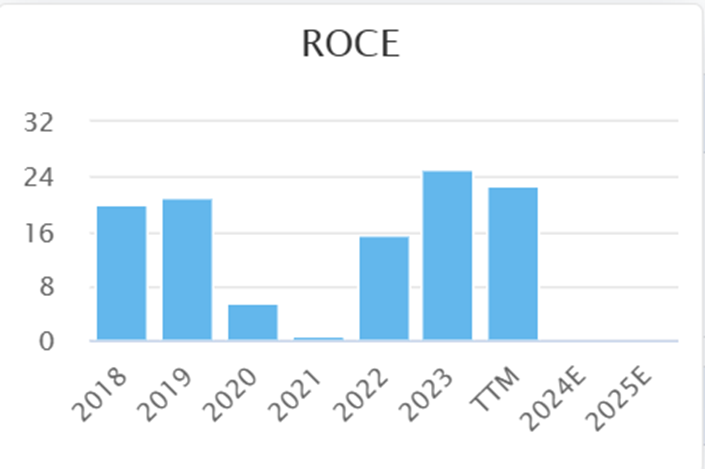

There is an even better reason to consider Billington a Quality stock, and this is because it regularly earns a return on capital significantly above its cost of capital:

It isn’t the perfect share in this regard. It struggled during the COVID-19 years when there was little investment in construction. This cyclicality is why the stock is on a forward P/E of 7, not 27. From studying high-return quality compounders, I have developed what I call an MROC framework. I am looking for companies with a Moat, Runway to grow, have Operational Leverage, and I want to buy them Cheap. I believe Billington hits all four of these criteria:

Moat

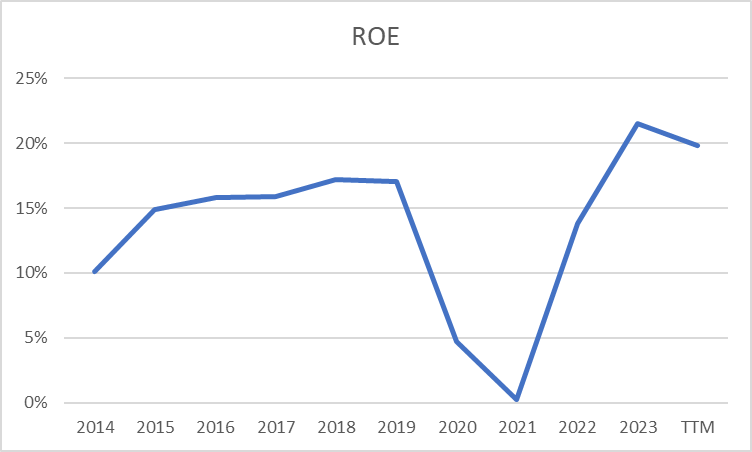

As already touched on, the ability to generate high returns on capital or equity most of the time is a sign that the company has a moat:

The ROE is particularly impressive here, as the company has held increasing net cash in recent years. In this case, the moat appears to be the niche they have in the structural steel market and the ability to deliver complex projects. This may not sound like the strongest of moats. However, the returns on equity suggest that competitors haven’t been able to breach it so far.

Runway

There continues to be scope for a company of this size to take market share from larger competitors. In addition, the company has recently embarked on an investment program that will see greater automation in its process flows. This should see not just better efficiency but also an uplift in capacity. The benefits of this will take time…