For my contributions to the 12 Stocks of Christmas, I am choosing four stocks that epitomise Quality, Value, Momentum and Growth for me. I’m starting with Value:

On the 8th Day of Christmas, my true love gave to me:

IG Design (LON:IGR)

It is apt that IG Design is one of my Christmas stocks as they design and manufacture a huge number of Christmas products. Greetings Cards, Gift Bags & Boxes, Gift Wrap, Gift Tags, Accessories, Crackers, Partyware, Decorations, Santa Shop, Christmas Fun, Stationary Essentials, Santa’s Grotto and Christmas Display Solutions are just the category headings in their UK Christmas 2025 Catalogue. They are not all about Christmas, but even their non-seasonal products, such as Frames & Albums, Calendars & Diaries, and Kids Create, will have highly seasonal sales trends aligned with the same period.

IG Design has been on a bit of a rollercoaster ride in the last 10 years:

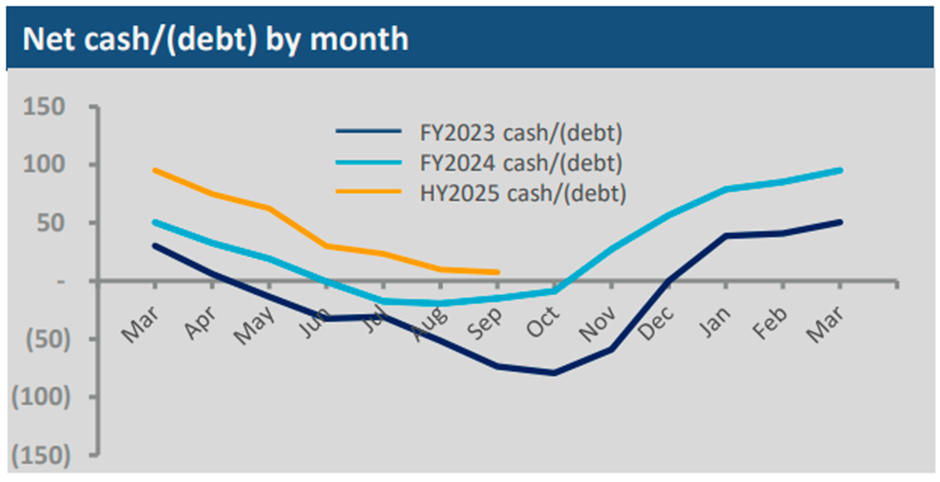

It 10-bagged from 2015-2020 as it pursued a growth strategy, but like many companies that prioritise sales growth above all else, it became unstuck. Partly, this was the impact of COVID-19, but then inflationary effects led to losses in 2022 and 2023. The company came close to insolvency in 2022, which seems strange for a company that regularly reports net cash. However, like many companies, the balance sheet date is carefully chosen and represents a seasonal high. The effect of having to order stock early and inflationary pressures meant that the working capital position put significant stress on the balance sheet.

While management changes are not always good for a struggling business, in this case, they appear to have been the catalyst for positive change. Paul Bal was appointed CFO on 1 May 2022 and was subsequently promoted to CEO on 1 April 2023. His focus on financial discipline can be seen in the net cash (debt) trajectory year-on-year:

With solvency no longer in doubt, investors can focus on the valuation, which looks very cheap on many metrics:

Leading to an impressive 96 Value Rank:

The key metric that makes this a value play for me is the 0.55xTBV. Most of this is inventory and receivables.…