Last year we introduced our festive stockpicking series, the 12 Stocks of Christmas. During the quiet period between Christmas and Twelfth Night, we brought you 12 pieces of company analysis covering ideas from our own watch lists.

While these weren’t stock tips, they were companies we liked for various reasons and felt optimistic about for the year ahead.

Twelve months later, we’re now putting the finishing touches to the 2026 edition of the 12 Stocks of Christmas. They will be rolling out daily from 25 December through to 5 January.

However, before we share this year’s batch of 12 stocks, I want to take a look at the performance of last year’s selection and explain why we’re tweaking our approach this year.

How did we do?

A year is both an eternity and a very short period in the markets. Many things have happened this year that might not have been expected 12 months ago. I suspect the next 12 months will also contain a few surprises.

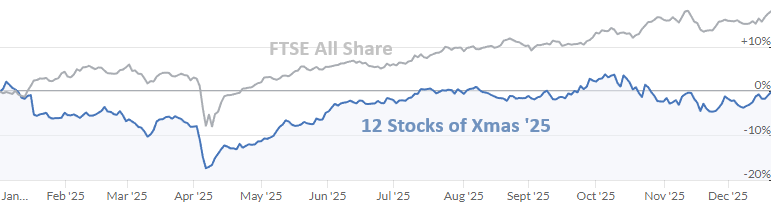

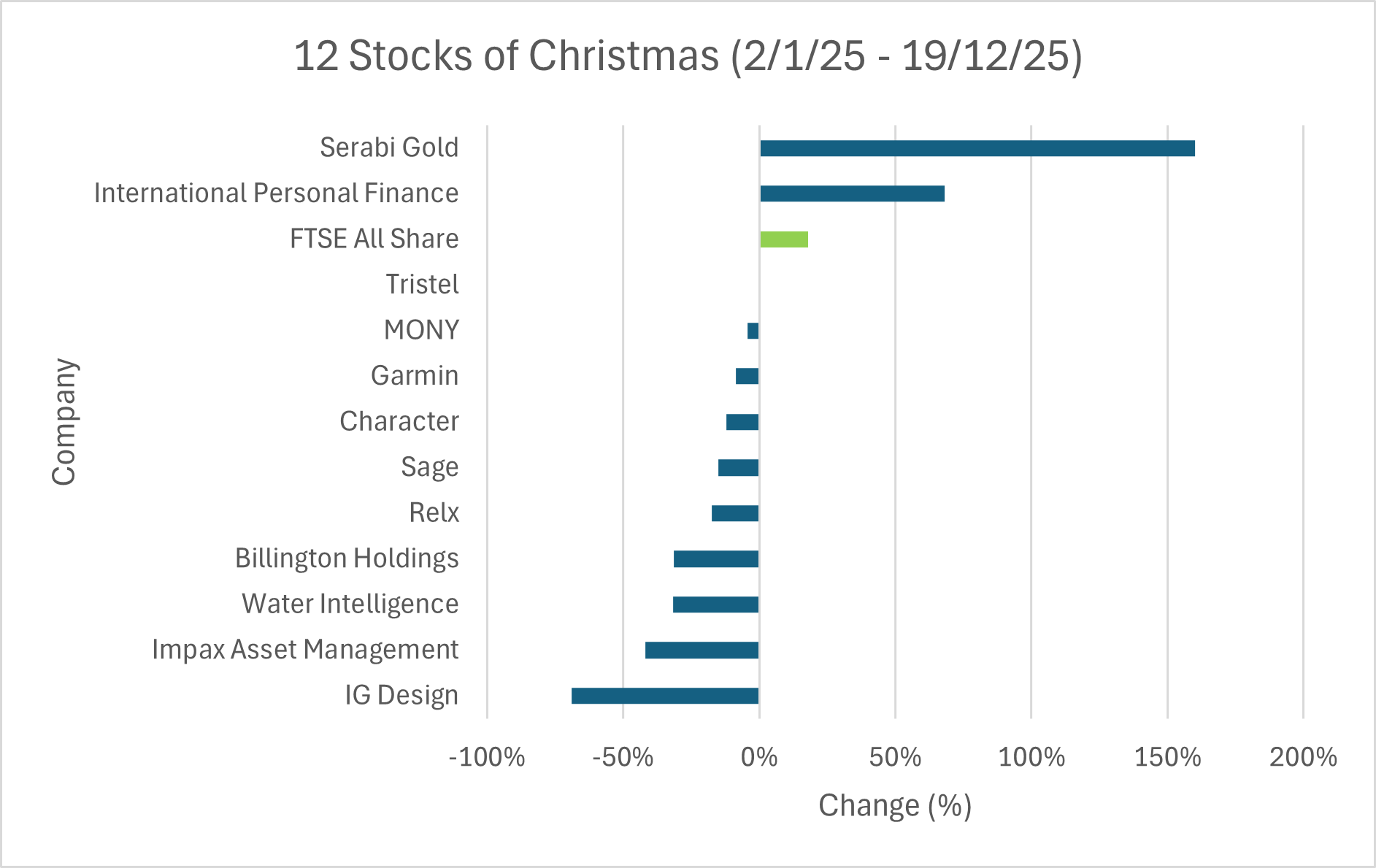

How did our 12 Stocks perform in 2025? The short answer is that a few did well, while a larger number did not. Here’s a snapshot:

The average return was -0.3% – well below the 18% return generated by the FTSE All-Share index over the same period (all figures exclude dividends and fees).

This is clearly a disappointing result, so what can we learn from this?

Drilling down into the data

We’re data-driven investors here at Stockopedia. We believe in trying to identify and benefit from financial factors and other patterns that have been found to repeat themselves over time.

In this case, the simplistic view I’ve presented above excludes some valuable data about the performance of our selection last year.

The stocks we selected last Christmas fell into four different StockRank styles:

StockRank Style (#) | Companies |

Super Stocks (4) | Serabi Gold (LON:SRB), International Personal Finance (LON:IPF), Water Intelligence (LON:WATR), Billington Holdings (LON:BILN) |

High Flyers (4) | Tristel (LON:TSTL), Garmin (NYQ:GRMN), Sage (LON:SGE), Relx (LON:REL) |

Contrarian (3) | Character (LON:CCT), Impax Asset Management (LON:IPX), IG Design (LON:IGR) |

Neutral (1) |

.JPG)