For my contributions to the 12 Stocks of Christmas, I am choosing four stocks that epitomise Quality, Value, Momentum and Growth for me. Finally, it is the turn of Growth.

On the 11th Day of Christmas, my true love gave to me:

Water Intelligence (LON:WATR)

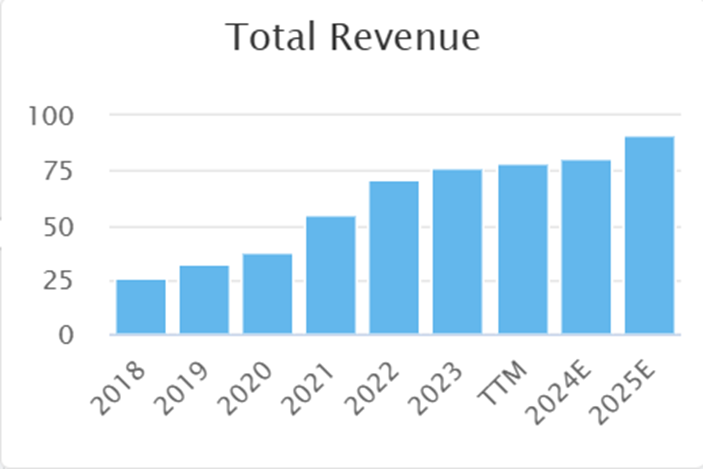

Water Intelligence is both an operator and a franchisor of minimally invasive leak detection systems for water pipes. Demand for their services has grown strongly in the last five years:

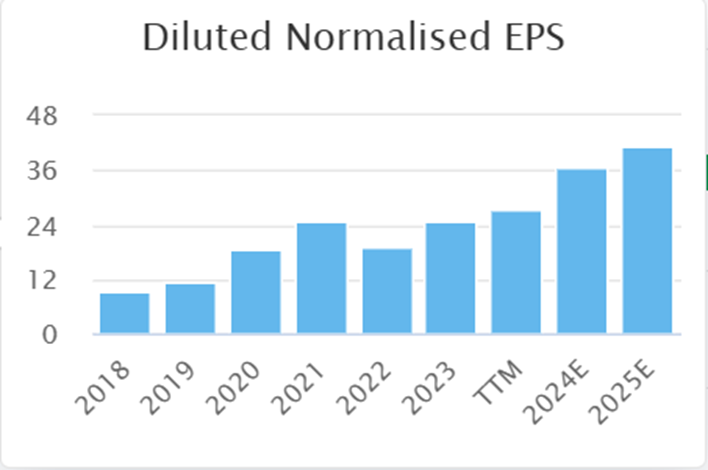

Over the last 10 years, their sales have risen tenfold, making it one of the fastest growers on the UK market. The 5-year sales growth works out to be 24% CAGR. However, despite a high gross margin, there hasn't been any sign of operational gearing. The 5-year CAGR here is still impressive at 22%, and EPS growth is forecast to accelerate, growing 48% year on year:

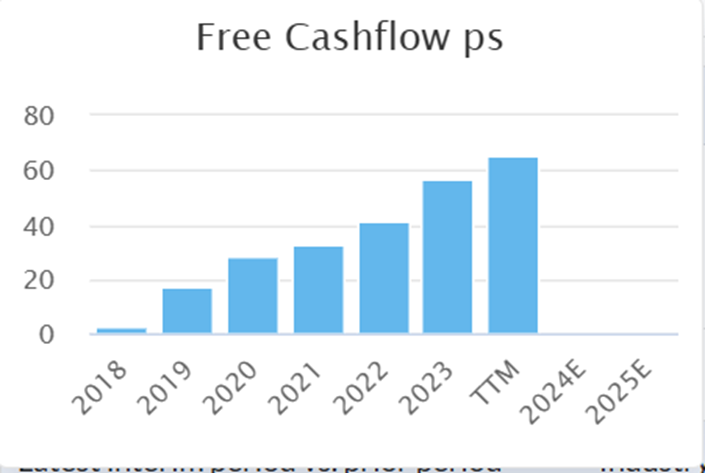

As you would expect from a franchisor model, growth has been cash-generative:

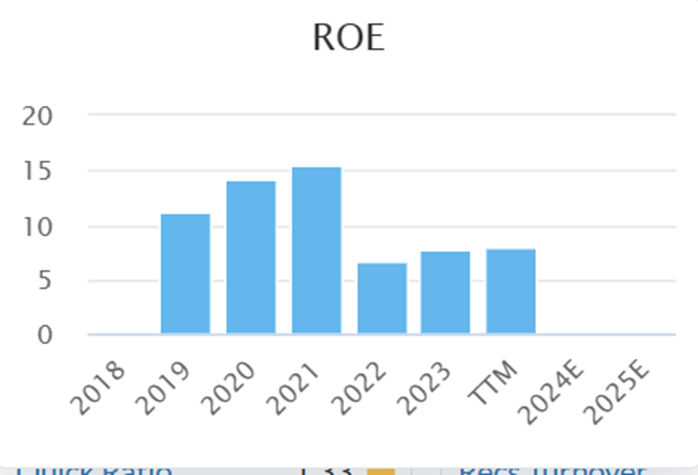

However, Returns on Equity are below what you’d expect for such a business, leading to questions as to whether this growth has added shareholder value:

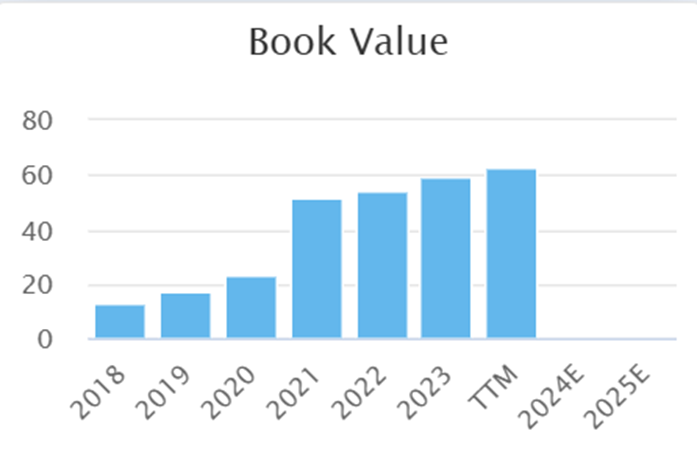

The low ROE comes about from a step change in Book Value in 2021:

In addition to minor international acquisitions, the company has been using all its cash plus money raised from the market to acquire its franchisees. So, the increase in book value is primarily the goodwill from these transactions. The reality is that this appears to have largely moved away from the capital-light franchisee model in favour of greater control over the business. This has made it an excellent growth business, but perhaps not a quality compounder due to its low ROE and lack of operational gearing.

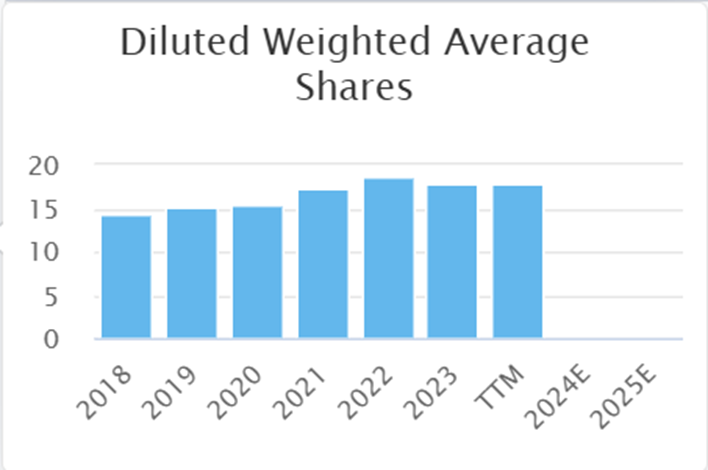

No dividends have been paid, but a share buyback program has been initiated at the end of 2024. However, the share count has still risen over the last five years since there has been dilution from options exercise, and they raised £16.2m from the market in 2021.

At least they had the good sense to do this at 960p and…