To follow up on my Warren Buffett-style stock screen from last week, I thought it would be interesting to take a look at some of the companies that appeared in the screen results.

The two stocks I’ve chosen have some characteristics in common, but they’re both also quite distinctive businesses. I think it’s possible that if Buffett was a UK small/mid-cap investor, he might be interested in both of them.

As always, the shares I’m going to discuss are only ideas for further research, not stock recommendations.

You can see (and duplicate) my Warren Buffett screen here.

Note: As I mentioned in last week’s piece, the construction of the screen effectively excludes banks. US banking stocks form a sizable part of Buffett’s own portfolio. I think that some UK banking shares also look attractive for long-term investors at the moment – this is a subject I hope to revisit in the coming weeks.

James Latham (LON:LTHM)

What it does: James Latham (LON:LTHM) is one of the UK’s leading distributors of timber, panels and decorative surfaces. It’s a family-run business that’s been importing timber into the UK since 1757.

Ownership remains heavily concentrated in family hands. Two members of the current board are Latham family members, including chairman Nick Latham:

Does Buffett own anything similar? Based on Berkshire Hathaway’s reported equity holdings on 30 September 2022, Buffett has substantial equity holdings in at least two US building materials businesses, Floor & Decor Holdings (NYQ:FND) and Louisiana-Pacific (NYQ:LPX).

Stock Review: James Latham is an AIM-listed small-cap, with a market cap of £266m. However, the company has a long record of excellent financial performance. This has been reflected in excellent shareholder returns over time – the stock has 16-bagged over the last 20 years:

Lathams also did very well during the pandemic, benefiting from surging demand for home improvement and building materials.

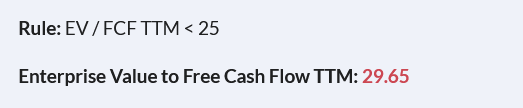

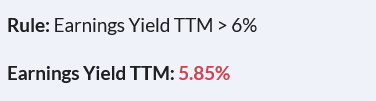

The shares qualify for eight guru screens at the time of writing. They’re also well-regarded by Stockopedia’s algorithms, with Super Stock status and a high StockRank:

Profits are expected…