Our 2013 review of the 60 GuruModel investing strategies tracked by Stockopedia picked up on some incredibly strong performances. Strategies that focus on small and mid-cap companies soared as investors swept into riskier parts of the market. It was perhaps a tall order to expect that confidence to stay intact. After all, many stocks on stretched valuations were under pressure to hit earnings expectations. With many of them missing those targets, earnings season turned into a bloodbath for some and 2014 proved to be much more challenging for the gurus.

The long-only GuruModels span a range of investment disciplines - from deep value small-cap bargains to high yield blue-chip income. That means benchmarking them against a single index isn't always that useful. Likewise, the demanding criteria of these screens means that some of them don't always offer up adequate numbers of realistically investable stocks.

| Index / Strategy Composite | 1 Year Performance |

| FTSE 100 | -2.7% |

| FTSE 250 | 0.9% |

| FTSE All Share | -2.1% |

| FTSE SmallCap XIT | -4.8% |

| AIM All Share | -17.4% |

| AIM 100 | -20.7% |

| Top 10% StockRank stocks (> £10m Mkt Cap) | 1.2% |

| Guru Strategy Composite | -2.65% |

| Income Composite | 1.0% |

| Growth Composite | -0.8% |

| Value Composite | -1.9% |

| Momentum Composite | -3.2% |

| Quality Composite | -3.9% |

| Bargain Composite | -9.8% |

Caveats aside, the overall GuruModel Composite just beat the FTSE 100 by 0.05% and the FTSE All Share by 0.55%. But it did better against small cap indices which may be more appropriate - beating the FTSE SmallCap by 2.15% and the AIM 100 by over 18%. The notable poor performance of the AIM 100 last year, down 20.7%, was exacerbated by a handful of single stock wipeouts. Tumbling prices at previously high flying shares like Asos, Quindell and Monitise all dragged on the performance.

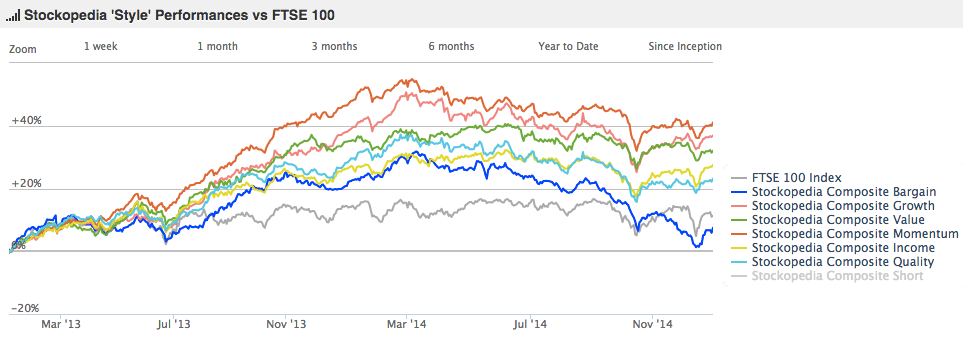

Individually, all the strategy composites except the Bargain Composite remain ahead of the FTSE 100 over the past two years. During that time, the best overall performance has come from the Momentum strategies, which have produced a 41% return.

Which investing strategies worked in 2014?

Overall, it was the Dividend strategies that managed a whisker of outperformance this year - as we wrote about in detail here. Growth strategies also held up well, with our interpretation of US investor William O'Neill's CAN-SLIM strategy topping the list with a 9.9% return. Among the highlights during the year, the strategy…