2016 was a tale of two halves for the 60 guru-inspired investment strategies tracked by Stockopedia. A year earlier, growth strategies had been the big winners in a flat market, but that changed in 2016. For a start, there was a revival in natural resources sectors that spurred the performance of value strategies. But then came the EU referendum, after which index valuations took off across the board. It was a year when the the legends of finance once again showed how different investment styles can respond dramatically to wild swings in investor sentiment.

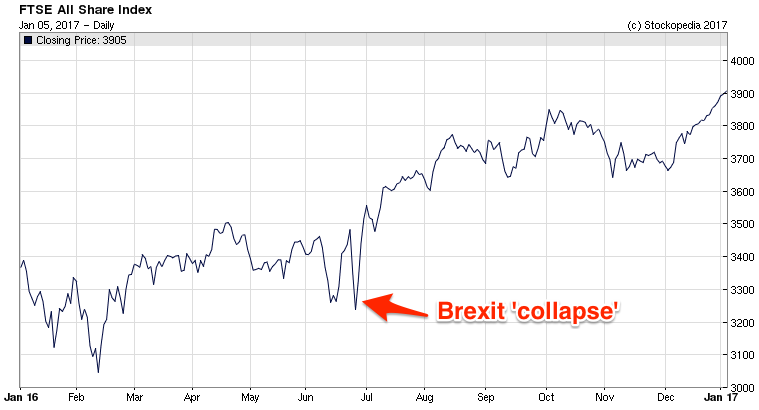

Prior to the EU referendum on June 23, it had been a fairly muted year for indices like the FTSE All Share (below). But after a pull back following the Brexit vote, some of them went on to perform well. That said, it’s undeniable that there is still a lot of uncertainty about the outlook for the economy and corporate earnings.

Before diving into how the guru strategies fared, it’s worth saying that performance stats over short timeframes need careful handling. For most investors, constant tracking and benchmarking is only useful up to a point. Not only can it be misleading, but it’s this sort of thing that causes so much short-termism and underperformance in professional fund management. For long-term investors, over-analysing what the FTSE 250 did over the past six months is next to no use at all. Ed covered some of these ideas on benchmarking in his recent NAPS article.

But what is interesting is having a look at how different investment styles responded to the agony and ecstasy last year. For those new to Stockopedia, since late 2011 we’ve been tracking the returns from a range of approaches used by some of the world’s best known investors. They are categorised as either Quality, Growth, Value, Bargain, Income or Momentum.

Each strategy has its own set of rules, and we constantly screen the market for companies that meet those rules. At the end of each quarter, the companies meeting the rules are scooped up into a portfolio for each strategy, which we track. Note, however, that these models aren’t always realistically investable, and sometimes there may be few companies that meet the rules of some of them. In addition, we don’t account for the drag of trading costs or the bonus of dividend…