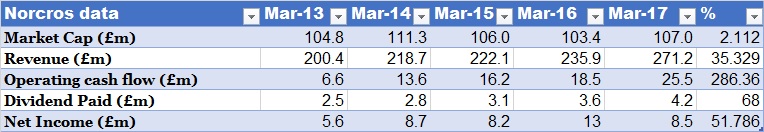

Norcros, the owner of Triton, Croydex and Johnson Tiles has been struggling lately, regarding growth in their share price movement. In fact, Norcros share price has gone nowhere for four years, despite showing clear operational improvement and higher profitability. Here are the anomalies:

If you compare the market value against net income and operating cash flow, it’s like night and day.

So, why are investors shunning this stock?

A tough question that requires a thorough investigation. Here are five reasons investors could concern themselves about Norcros:

South Africa Issue

South Africa has been in the news for its political crisis, which doesn’t help with its social and economic stabilities. The most important effects from its South African would be poor sales generation and a hit on its profits when the Rand get converted back to the British Pound.

The weakness of the South African Rand is noticeable against the U.S. Dollar when it fell from 6 Rand to 12.8 Rand to 1 U.S. Dollar in six years.

Despite the UK seeing a similar weakness, the British Pound is actually stronger than the South African Rand by appreciating from 10 Rand to 16 Rand in the same period.

Now, we compare Norcros South African operations. Sales did stagnate (2011: £72.4m; 2016: £72.9m), but operating profits have grown from £0.2m in 2011 to £4.1m. Today, results saw its South African operation generate £88.9m in sales and £6.4m in operating profits.

So, the weakness in its share price doesn’t come from South Africa.

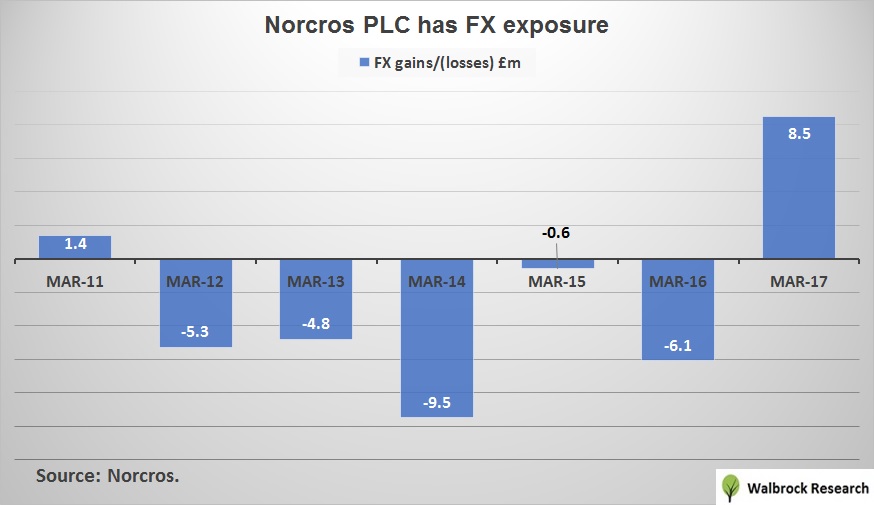

Foreign Exchange gains/losses

Given the weakness in the British Pound, how prevalent is this to investors? The graph shows big FX losses.

In the last seven years, Norcros saw FX losses totalled £16.5m. Compare that to the net profit of £60.1m during the same period, the company saw slightly more than a quarter its profits have been eaten away by adverse FX.

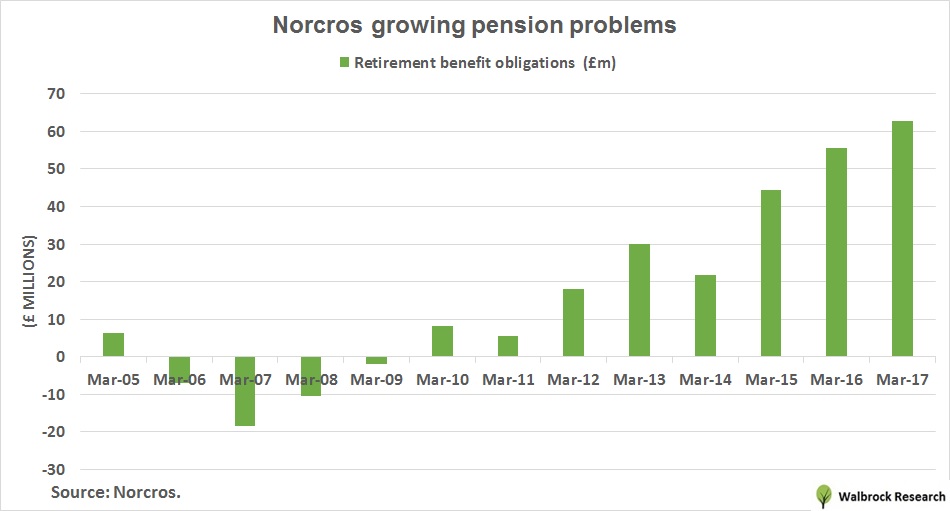

Growing pension deficit

On an annual basis, Norcros saw its pensions obligation turned from surpluses into deficits in 12 years (See below).

That growing deficit means Norcros will one day have to reduce that deficit from operational cash flow, therefore future profits are expected to come in below…