This week I’m going back to basics. I’m going to try and create a screen that uses the simplest rules possible to help me find good dividend shares.

I’ll then give some suggestions on how I might use the results to start building an income portfolio.

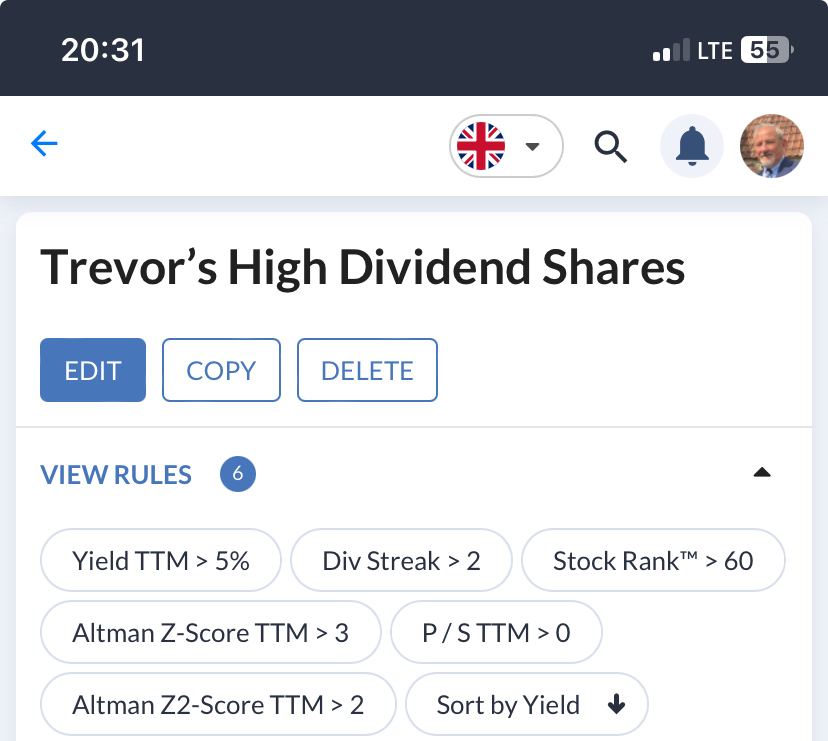

The screening metrics I’ll use will be simple and widely used. I will also use as few rules as I think possible, instead leveraging the power of Stockopedia’s excellent data set and the StockRanks to help me find suitable shares.

This approach is intended to be of interest to newer investors, but I think it should also be useful for more experienced investors as well, as it provides plenty of ideas for further in-depth research.

Why go back to basics?

I’ve written a lot about screening over the years. I think screens are a great way to help narrow down our investment universe and find shares with the characteristics we want. But this approach isn’t without risks.

One of these is over-complication. Many top investors have warned of the dangers of complexity, including Warren Buffett:

The business schools reward difficult complex behaviour more than simple behaviour, but simple behaviour is more effective.

When building a screen, it’s tempting to use many exotic and precise metrics to try and find companies with particular qualities.

Doing this may produce a gratifyingly small set of results. This makes it easy to believe you’ve discovered the holy grail of investing strategies and have identified precisely the best shares to buy today.

Unfortunately, this is unlikely to be true, at least in my experience. As Ed has explained previously, the perfect stock doesn’t exist. A portfolio of 10-20 stocks with slightly different characteristics is usually a more fruitful approach to investing.

Another risk with overly precise screening is that you may end up subconsciously reverse-engineering your rules so that they select shares you are already attracted to.

With these caveats out of the way, let me explain how I’ve approached this screen.

Building the screen

I’m looking for well-established companies, with a decent record of dividend payments, a reasonable yield and no obvious signs of excessive debt.

I also want good liquidity – and to avoid anything that might be a special situation or which might require in-depth…