Shares in BT (LON:BT.A) are popular with many investors. It’s a big company; a market leader in a safe, steady industry which is relatively insulated from economic turbulence. Most of the time that’s the sort of thing I go for as well. Safe, steady companies, preferably with high yields and high returns without high risks.

So when a subscriber recently asked me for my opinion on BT, I thought I’d crunch some numbers to see how the shares stand up under closer scrutiny.

1. If you’re looking for a solid track record of growth, you won’t find it here

The first thing I like to see in a company is an upward trend in revenues, earnings and dividends over time. I don’t like to rely on investor sentiment to make money in the stock market; I prefer to invest in growing companies so that an increase in the share price is almost inevitable.

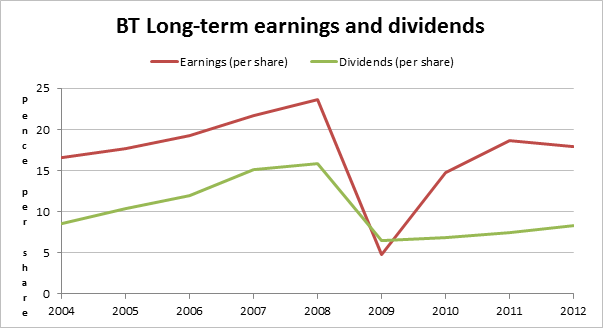

Alas, I was somewhat disappointed in BT’s longer-term track record, which you can see below.

Even ignoring the somewhat depressing 2009 figures, things aren’t looking good for BT. The results today are essentially where they were many years ago. That’s not exactly a stellar growth story, so it may be somewhat optimistic to assume high rates of growth in the future. This means that strategy number 1 – pick companies with long histories of consistent growth, goes out of the window.

2. The price to earnings ratio is nothing special either

If you can’t reasonably assume high rates of future growth, a second backup strategy is a share price re-rating. This sometimes happens when a company’s shares are very cheap relative to earnings, perhaps because of some short-term bad news which, given enough time, will pass.

The PE ratio today is around 12.3 which as most experienced investors will tell you, is nothing more than okay. In fact it may be less than okay given that the company shows no signs of reliable growth.

However, I prefer to look at today’s share price relative to the average earnings over the last 10 years. This can give a more consistent indication of a true value investment, and value investments are often the ones that get re-rated upward.

BT’s 10 year earnings average figure comes out at 17.2p, which gives a…