In my last article, I started going through the results of my 52-week lows screen. I reviewed the screen results from the Recruitment, Household Goods and Property sectors. The idea was to sort the screen results into stocks that were hitting 52-week lows for good reasons, and those that were languishing simply because they had been overlooked by investors. In the current markets, finding the latter may present a short-term opportunity, as anything that puts these on investors' radars again could deliver a significant re-rating.

This week, I'm continuing the exercise by reviewing screen results from the remaining sectors: Industrials, Extractive Industries, and any other relevant areas.

Industrials

Strix (LON:KETL)

Strix has a rather familiar chart since listing. It was considered a business with a strong moat in kettle controls (hence a ticker that is nothing like its name). Investors got carried away with the valuation of this (and similar businesses) in 2021, and a combination of inflation, weaker demand and debt has seen the shares lose almost 90% of their value:

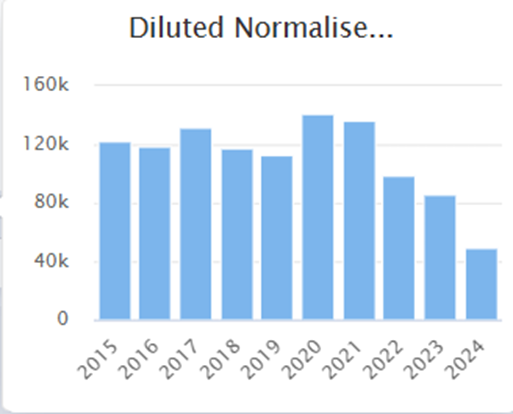

EPS, while clearly weak over the last few years, shows how exaggerated share price moves can be compared to the underlying performance of a business:

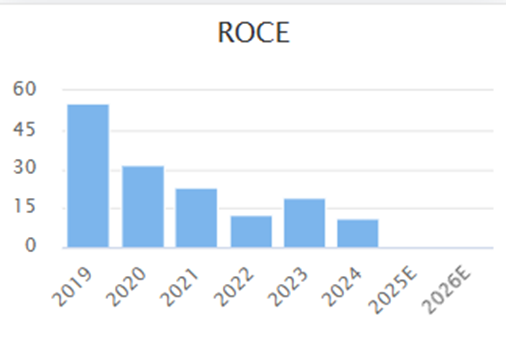

Part of this may be explained by the perception of the market that the moat here is being eroded, and kettle controls are now a commodity business. The ROCE has taken a battering recently:

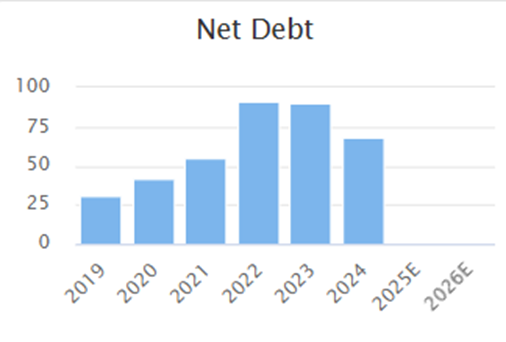

Although part of this will simply be due to lower EBIT, and any recovery here will see ROCE increase along with it. The answer to these trends from management has been to acquire related businesses in growth areas. In 2022, Strix acquired Billi Australia, Billi New Zealand, and Billi UK in a deal worth £38 million. In the same year, they also acquired LAICA, an Italian company focused on water purification. This largely explains the jump in net debt:

Along with higher net debt and weaker core trading came the need for a relaxation of banking covenants and higher interest costs. This meant they raised £8.7m of capital from the market in 2024 at 80p, representing an additional 5% of the issued share capital. The dilution…