I own the stock, Do your own research. Do your own reading. Nothing is a substitute for your own research. Fact check everything.

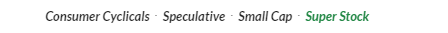

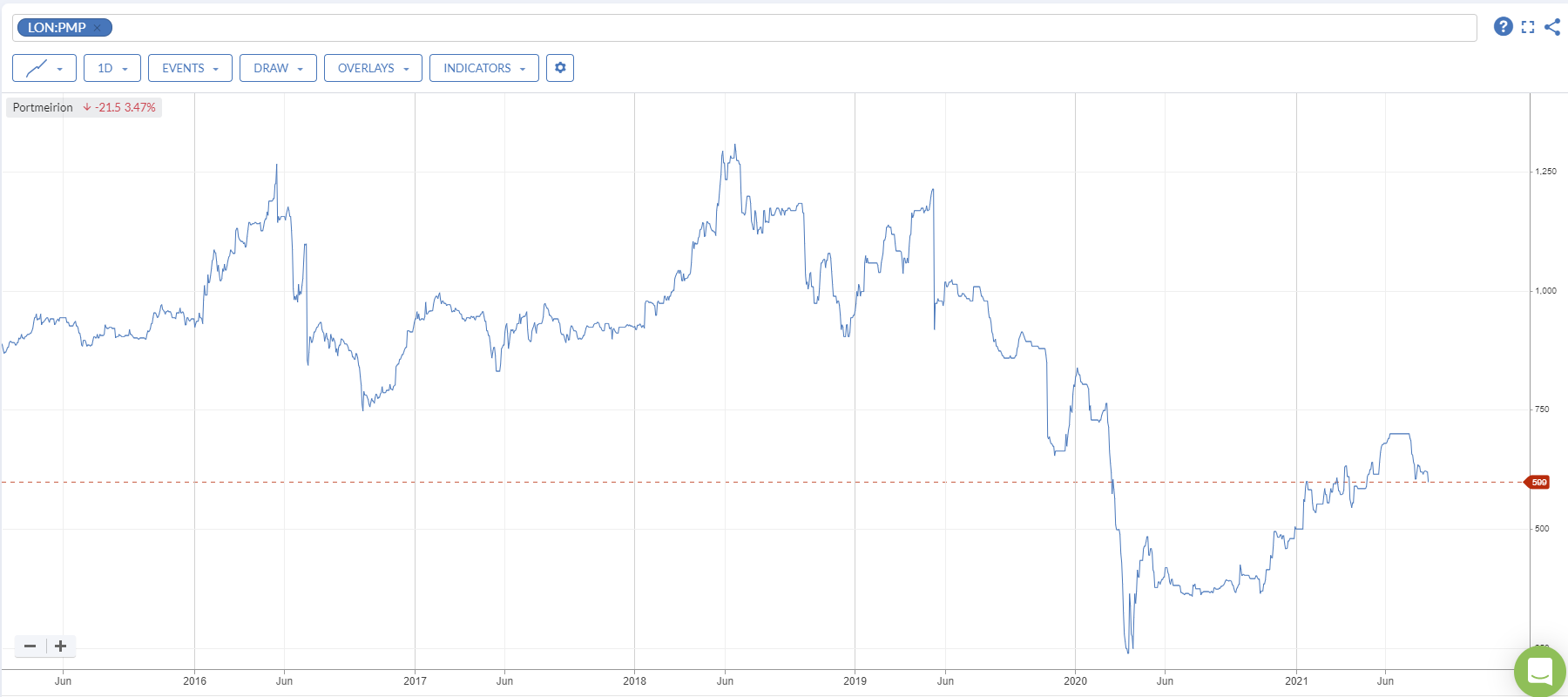

My TLDR opinion: Portmeirion is a quality British homewares business with nostalgic brands that has been left behind in a booming stock market. The next year PE ratio is only 10 on too low broker estimates. It is a Stockopedia 'Super Stock'.

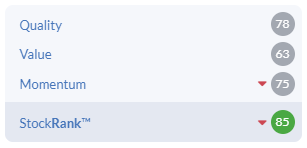

Portmeirion Portmeirion (LON:PMP) description: "encompasses six unique and established homeware and home fragrance brands: Portmeirion, Spode, Wax Lyrical, Royal Worcester, Pimpernel and Nambé."

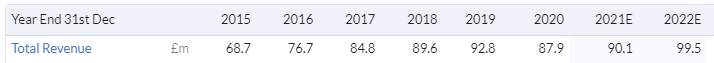

StockRank: 85; Market Cap: £82.5M; Sector: Consumer Cyclicals; Net cash: £0.7M

Price to EPS Ratio: 12; PEG: 0.656; Predicted dividend yield: 2.8%

Portmeirion is a British homewares company. Their tagline is timeless design which is true because their brands have been around for literal centuries (Spode since 1770). 38% of sales are in the US, 36% are in the UK, 15% are in South Korea and the rest is in tens of export countries in the world. It did £88M of turnover last year. The brands are found in many places, like Amazon.co.uk or Bloomingdales.

Bear points

1. Brands need upkeep. Portmeirion had a fabulous track record up until 2018, but management did not innovate and systems were tired. A brand business needs investment just like Nike or Superdry and they have been neglected before. They also saturated the South Korean market before and needed two years to recover from that.

2. Portmeirion is a seasonal business and the holiday period in December matters for them. Portmeirion has a second half reliance in its business where it makes most of its profits

3. Portmeirion outsources normally 50% of production to the Far East. A big part of this is into the Asian markets but supply chains matter

4. The new strategies of online penetration and automation are immature and there are risks to them

5. Portmeirion did a big share issuance during the pandemic to give funds to renovate the business. This diluted past shareholders.

6. Portmeirion's dividend has not recommenced yet even though the CEO says one will be committed to at the end of this year

7. The pandemic hurt the business. Turnover was down 11%…