Investing is about managing uncertainty. Share prices move in ways we can’t predict, and that’s especially true when it comes to takeovers. The key question for investors is this: are takeovers completely random, or do they leave detectable fingerprints?

If someone tells you this or that company will go up, you may be speaking to a crook, perhaps someone like Gordon Gekko, the villain in Wall Street who boasts: ‘I only bet sure things.’ Gekko was loosely based on Ivan Boesky, who in the 1980s made a fortune trading on confidential takeover information. Boesky would source insider secrets, buy up shares in takeover targets and sell after the price pop. It was a foolproof strategy, precisely because it was illegal.

In the movie, Gordon Gekko tracks the private jets of corporate executives, as if air traffic can be used to predict takeover bids. The irony is that investors don’t need inside information to improve their odds. There is no magic formula to predict takeovers, but investors can tilt the probabilities in their favour by using publicly available data.

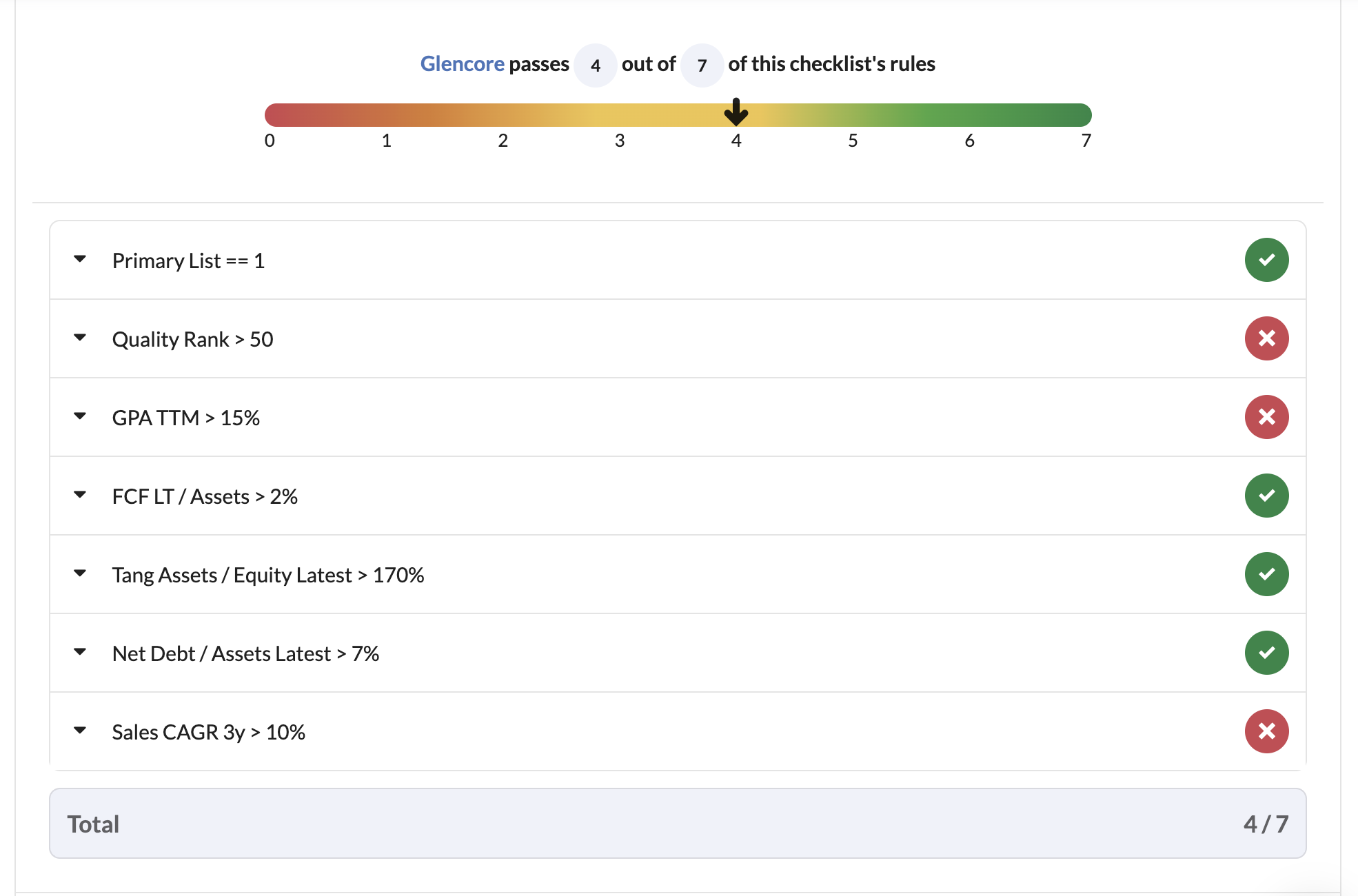

That is what we have done, as part of a deep dive series into takeovers. I’ve worked with Mark and our intern, Joe Hodges, to analyse 116 UK takeovers between 2022 and 2025. Last week, Mark gave an overview of UK takeover activity, outlining recent trends, deal structures, and premiums. This week, we go over the leading traits of takeover targets - i.e. the common characteristics that were apparent before the bid was announced. The results don’t offer certainty, but they do reveal a surprisingly consistent pattern. This can help us build a checklist for spotting potential takeover targets.

Never swim against the tide

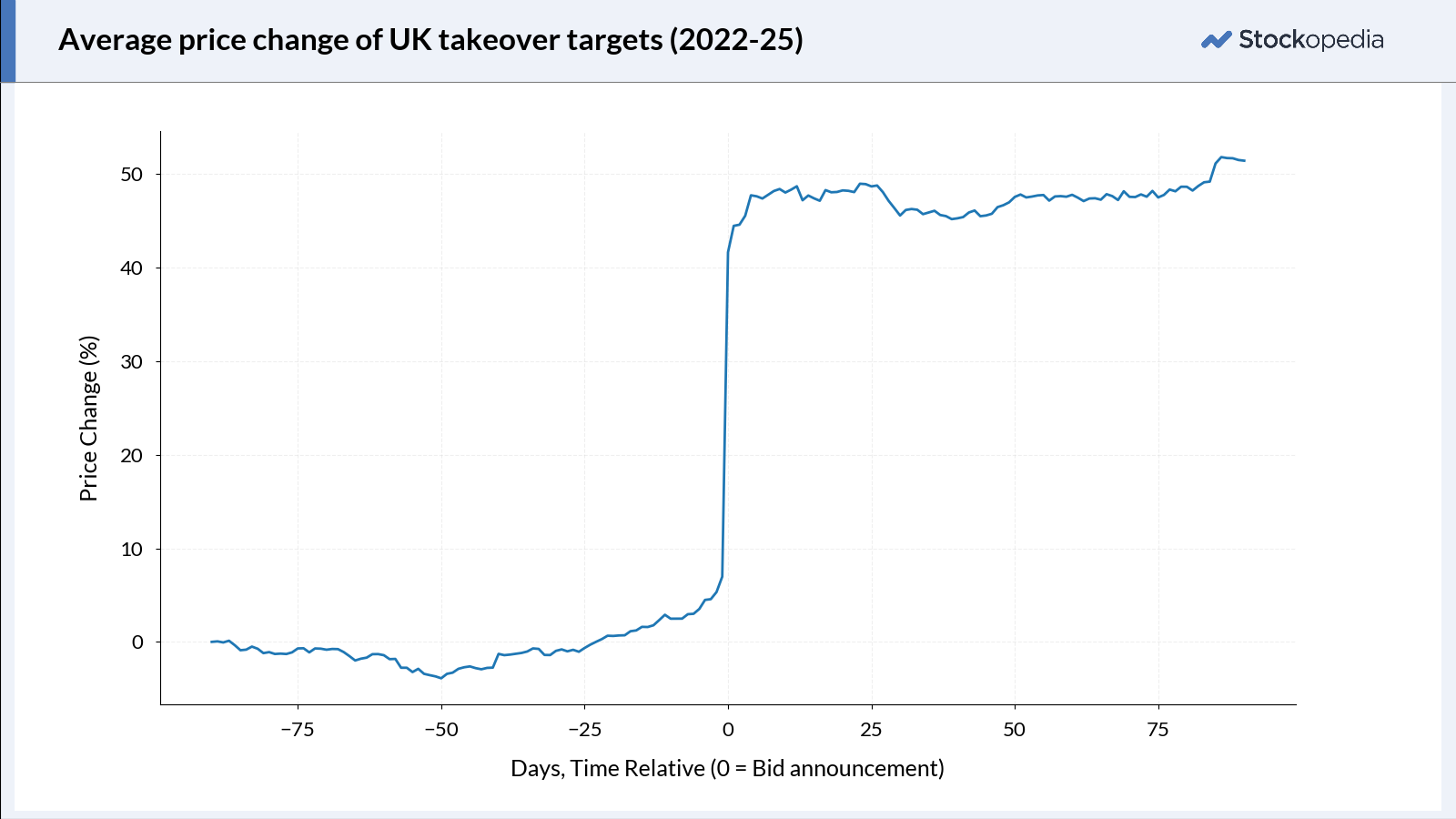

To find potential takeover targets, it may be worth accepting the wisdom of crowds theory — i.e. the idea that the market’s collective judgment can be more accurate than that of an individual investor. Takeover targets tend to show modest share price strength before a bid is announced. They generally had a pre-bid MomentumRank of 54, with stronger 3 month momentum than the control group. In this sense, takeovers are perhaps poorly held secrets, given that the takeover process involves multiple groups who sometimes leak material, price-sensitive information.

The early price weakness possibly reflected adverse market conditions in 2022-25 and may have been a short-term factor encouraging the…