I’ve been doing some digging into equity placings. It could be a good lead for identifying opportunities.

Companies will go bust in this lockdown but larger publicly listed operations generally have better access to funding and so should stand more chance of squeaking through - not that “squeaking through” will feel like a particularly fun process for anybody involved.

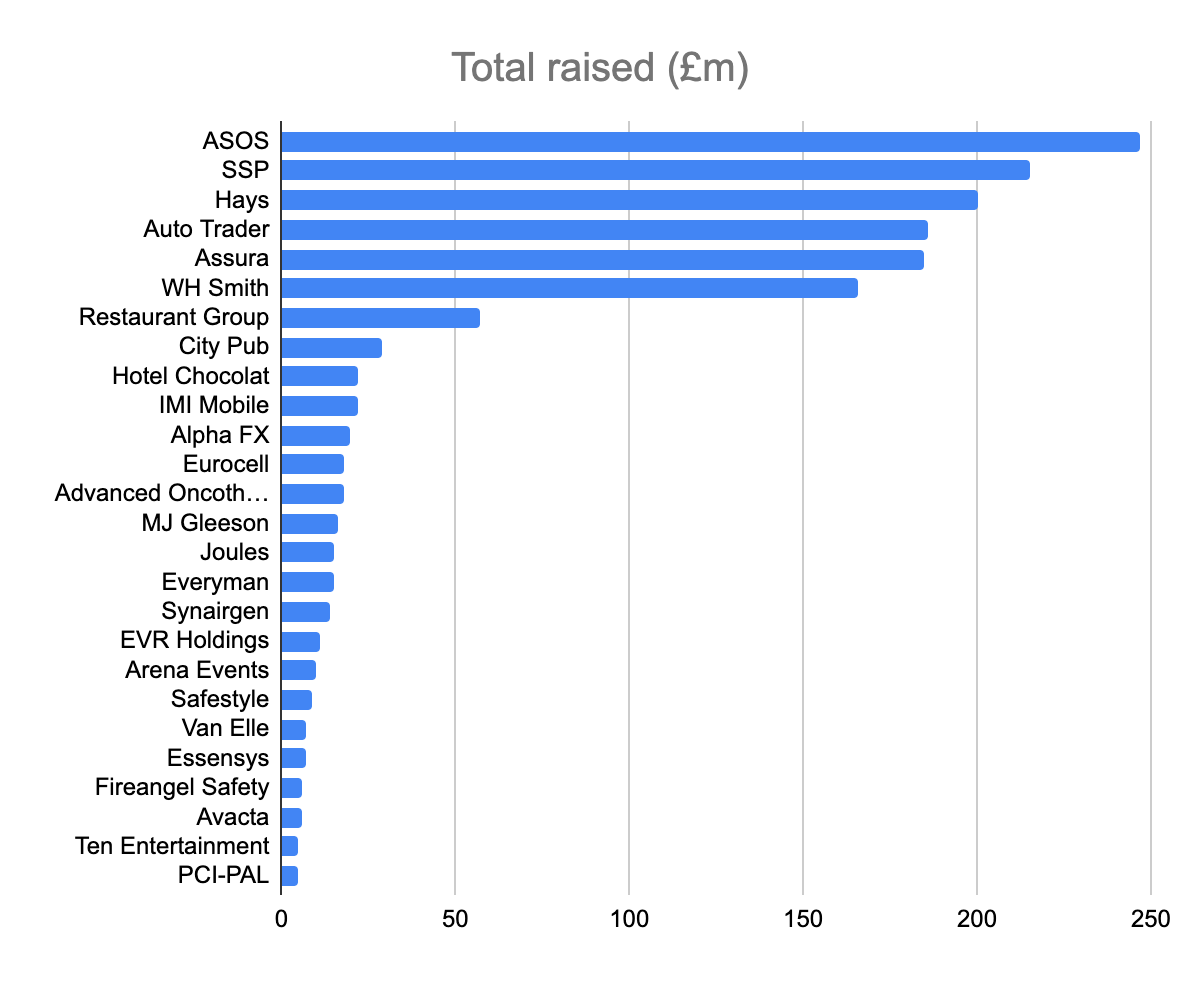

Since the middle of March I’ve found nearly 30 equity raises totalling c£1.5bn. Most of these raises have been to either address working capital needs or to strengthen liquidity and balance sheets.

I am actually slightly surprised by the number - I think there could be more placings in the coming weeks and some companies might end up wishing they had acted sooner. Appetite to participate in such placings, on the other hand, could rapidly dry up.

In fact, there have been two placings since I have started writing this and that I have not had time to incorporate: Gym Group and Hollywood Bowl.

Here’s a table of what I’ve got so far. If you see any I’ve missed, let me know and I’ll update it.

Company | Date | % of company sold | Total raised (£m) | Share price performance | Director purchases (£m) | StockRank |

8.5% | 22 | 23.71% | 4.20 | 48 | ||

66.7% | 6 | -15.49% | 0.00 | 18 | ||

20.9% | 11 | 4.86% | 0.77 | 7 | ||

36.6% | 14 | 194.79% | 0.07 | 19 | ||

19.3% | 215 | 4.71% | 0.76 | 48 | ||

5.0% | 5 | 6.90% | 0.31 | 85 | ||

62.2% | 10 | 0.00% | 0.25 | 45 | ||

73.7% | 29 | 67.97% | 0.00 | 31 | ||

39.2% | 5 | -4.93% | 0.00 | 21 | ||

10.0% | 18 | 15.77% | 0.09 | 78 | ||

5.1% | 186 | 10.26% | 0.00 | 36 | ||

21.0% | 15 | -5.91% | 1.18 | 30 | ||

14.3% | 200 | 12.36% | 0.10 | 58 | ||

13.7% | 166 | 8.30% | 0.47 | 60 | ||

11.1% | 6 | 325.21% | 0.00 | 29 | ||

10.0% | 185 | 6.63% | 0.00 | 48 | ||

60.4% | 9 | 37.10% | 0.11 | 60 | ||

18.8% | 247 | 42.63% | 0.66 | 31 | ||

7.3% | 20 | 14.44% | 0.36 | 49 | ||

23.8% | 15 | 31.18% | 0.36 | 18 | ||

19.9% | 57 | -12.72% | 0.06 | 39 | ||

4.9% | 16 | 4.05% | 0.17 | 48 | ||

33.0% | 7 | 48.61% | 0.93 | 97 | ||

23.8% | 18 | 12.27% | 0.19 | 4 | ||

9.9% | 22 | 6.2% | 0.00 | 61 | ||

9.6% | 7 | 6.35% | 1.14 | 44 | ||

1,511 | 38.89% | 12.18 | 42.76923077 |

In the set I have assembled since the start of the lockdown, UK-listed companies have raised about £1.5bn from the public markets. Directors of said companies have purchased just over £12m of stock.

In absolute terms, the largest raise has been from Asos (£247m).

On average, share prices have improved by 39% on the pre-placing price, which suggests the market is so…

.jpg)