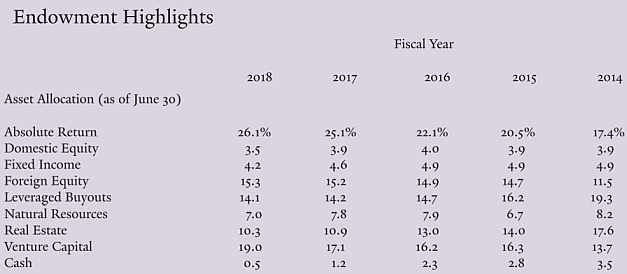

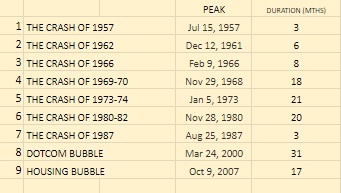

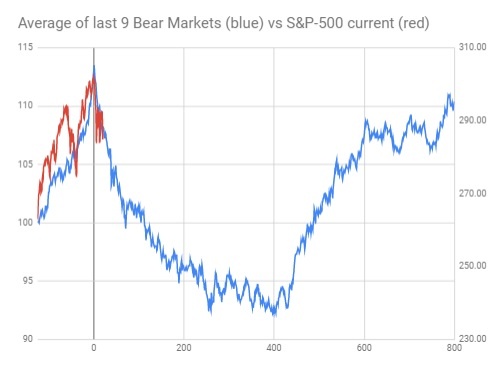

In view of a possible recession and bear market, I’m currently trying to construct a portfolio that will hold up better than a 100% UK based equity portfolio. My horizon is 5 years. Some of my ideas have been borrowed from the Yale University Endowment Fund which has achieved spectacular results over the last 25 years.

The asset allocation I’ve decided on is:

Individual equities (mainly US and defensives) – 20%

Mutual funds & index trackers (US, Global & Emerging Markets) – 30%

Alternatives (private equity, infrastructure, anything with a beta <0.5) – 30%

Gold & precious metals (as an ETF like £SGLD) – 5%

Bonds (Investable corporate grade via ETFs or funds) – 10%

Cash 5%

Individual equities

These are mainly non-cyclicals. My focus is on large US stocks with a moat, such as Microsoft, McDonalds and Visa. I expect a nominal return of >60% over the next five years regardless of economic conditions.

Mutual Funds and index trackers

With these I’m looking for low management charges, a 5 year history of performance that beats the relevant benchmark and global diversification. I expect a nominal return >50% over the next five years.

Alternatives

For my purposes these are investment trusts dealing in infrastructure and private equity. I’m looking for a beta <0.5 and a NAV discount >5|%. (E.g. £HVPE). I expect a nominal return of >60% over five years.

Gold and precious metals

Whilst gold gives poor returns in good economic conditions, it provides a hedge against an economic downturn. It is popular with emerging nations and currently it is being bought heavily by Russia, China, Turkey and Poland. If we enter global recession, I expect a nominal return of 20% over five years.

Bonds

The returns on bonds are poor compared with equities in the long term, but in a market downturn they tend to hold their value and give a regular return. Corporate bonds via a mutual fund or ETF are probably the best buy.In the aftermath of a crash, bonds can be converted to cash and used to buy under-priced securities. I expect a nominal return of 20% over five years.

Cash

Cash has a beta of zero so provides some balance for…