Back in 2013 Warren Buffett surprised many investors by setting his sights on Canada. He purchased shares in the Canadian oil giant, Suncor Energy Inc and by the beginning of 2015 this firm had replaced the US company, ExxonMobil, as Buffett’s largest energy holding. He also bought a sizable stake in Restaurant Brands International - the Canadian fast food company which owns Burger King. The Oracle of Omaha is not the only one who sees Canada as a good place to invest. The Economist’s Business Environment Rankings have consistently placed Canada amongst the most investor-friendly countries in the world. Many readers will therefore be pleased to learn that we will be providing in depth analysis on Canadian stocks as we go forward. We’ve put together this guide to give an overview of the reasons for investing in Canada and also explain how investors can get involved.

Why invest in Canada?

Dynamic Resources Sector

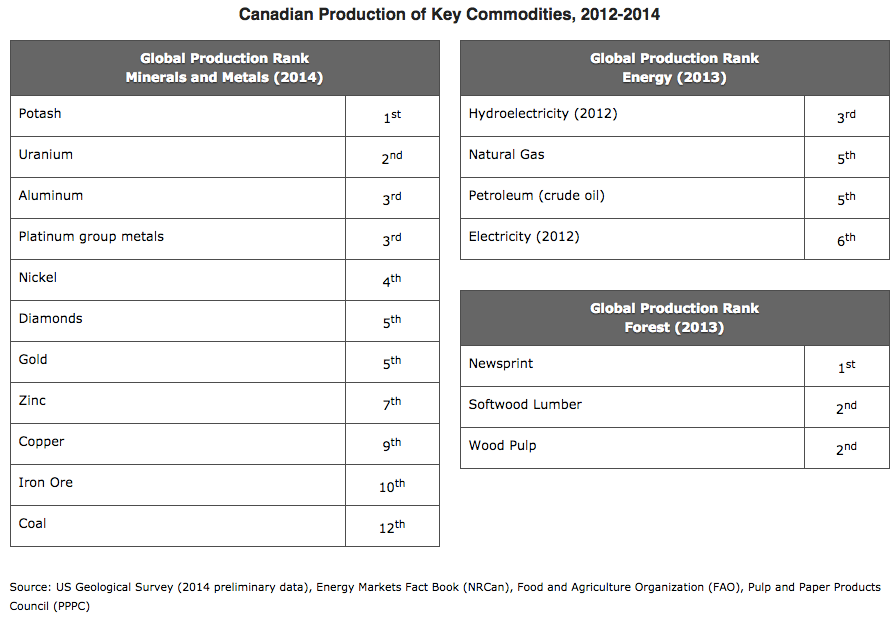

Canada is richly endowed with natural resources. Bitumen -which can be upgraded to synthetic crude oil- is found in abundance in the country’s oil sands. Indeed, Canada has the largest oil reserves in the world after Saudi Arabia and is currently the fifth largest producer of crude oil and gas. However, it wasn’t always that way. After the second world war the skeptics believed Canada's oil sands would never be developed commercially. One of the companies which proved them wrong was Great Canadian Oil Sands Limited (which later merged with Suncor Energy). During the 1960s the company acted as a pioneer in Canada’s petroleum industry when it received government approval to operate plants in Fort McMurray. Over the decades the firm has grown into the fifth largest energy company in North America. Another major energy company based in Canada is TransCanada. It generates enough electricity to power 11 million homes and in 2014 it delivered 20% of the natural gas consumed in North America. Both of these giants trade on the Toronto Stock Exchange. Beyond energy, Canada ranks among the top-three global producers of softwood lumber and wood pulp, and a leading producer of potash, newsprint and platinum group metals. A number of publicly traded Canadian companies benefit from this. For example Canfor and Interfor are both amongst the largest lumber producers in the world.

Vigorous Banking Industry

Canada has a vibrant financial sector. The World Economic Forum’s global…