In his excellent book, One Up One Wall Street, Peter Lynch explains that he loves 'dull' companies in 'no-growth' industries. “I get even more excited when a company with a boring name also does something boring”. Could the same perhaps be said for countries? If I asked you to name a dynamic growth economy, you'd probably mention one of the BRICs, like China or India. New Zealand would probably be the last country to spring to mind. One of our Directors at Stockopedia is a Kiwi, but despite the risk of getting fired I think it is safe to say that New Zealand meets Lynch's criteria - it’s a pretty boring place. It may have a great rugby team, but it doesn't have the growth story of an emerging market and it isn't particularly well known as a hub for glamorous industries, like Silicon Valley is for tech. So would Lynch think there is a strong case for investing there? Let's take a look…

International Value Investing

The reason Lynch likes boring companies is that they may to be overlooked by most investors and could therefore be cheap or undervalued. Cheaper stocks often beat expensive stocks. Research by Meb Faber also suggests that cheaper countries outperform more expensive ones. Faber recently calculated a composite valuation rank for 43 nations (see here). For each country he calculated the:

- CAPE ratio. The cyclically adjusted P/E ratio, is defined as price divided by the average of ten years of earnings. It therefore seeks to smooth out the economic cycle and allow for better comparisons over time.

- CAPD: Cyclically-adjusted price/dividend ratio.

- CAPB: Cyclically-adjusted price/book ratio.

- CAPCF: Cyclically-adjusted price/cash flow ratio.

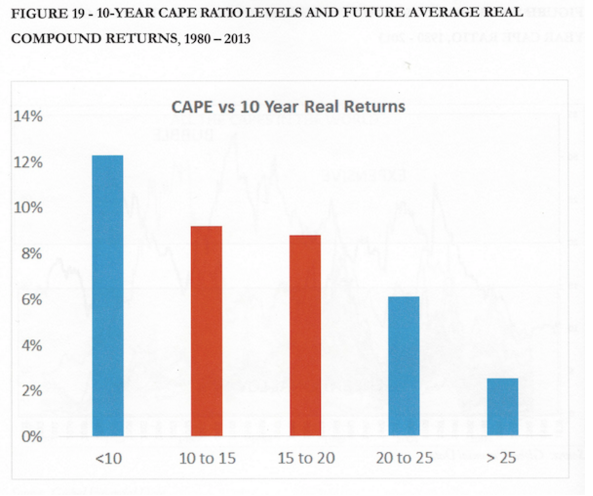

'Blue chip' economies like the US, Germany and Japan were amongst the more expensive countries. Emerging markets like China and South Africa were also more expensive. Cheaper stocks may be riskier, with a higher chance of bankruptcy. So it is interesting to see that Greece and Portugal were amongst the cheapest countries. We can see from the chart below, extracted from Faber's excellent book, Global Value, that nations with lower (ie. cheaper) CAPE ratios beat more expensive countries between 1980 and 2013.

So where does New Zealand fit into all this? Figures from Meb Faber's Idea Farm suggested that in early 2015 New Zealand was the 14th cheapest country in…