At Mello Workshop 2015 I spoke on how to construct a high-yield portfolio and documented the process; in this article I create just such a portfolio and discuss some of the questions that arose while following the rules.

Introduction

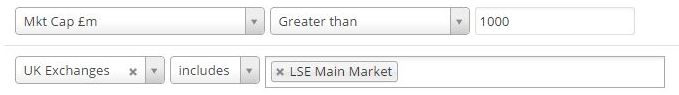

The first step towards selecting shares for a high-yield portfolio (HYP) is to create a shortlist of companies worth considering. I've used many screening providers in my time, such as Digital Look, but in this case I've put together a very basic filter on Stockopedia:

The reason for keeping it so simple is that all websites have some level of data error and odd values sometimes creep in (such as a forecast yield of zero for HICL Infrastructure when it's been yielding near 5% for years). It's also very easy for me to export the results to a spreadsheet and manually remove low-yielding shares and other unattractive companies (such as foreign entities with a secondary listing in London).

With this spreadsheet (available here in hand I've created a portfolio, of 25 shares, by working down from the very largest companies and considering a few key points:

- is their yield greater than that of the FTSE (roughly 3%)?

- are they in a sector which doesn't already have a selection?

- do they have a reasonable dividend history?

- are they in a reasonable financial state without carrying excess debt?

- are they in a stable or improving sector of the economy?

So without further ado let us move onto the first 15 shares which make the cut right now; the remaining 10 shares are covered in my follow-up article. The reason for this split is that fifteen companies provide the minimum sensible level of diversification for a portfolio and I feel that this blog post is long enough already!

The portfolio (shares 1-15)

1) Royal Dutch Shell [Energy - Oil & Gas]

The largest company in the FTSE, at a hefty £120bn, Shell is forecast to yield almost 6.5% this year and has an average 5-year yield of over 5%. The cover on this payout isn't great, at around 1.3, but Shell hasn't cut its payout in living memory and has the financial firepower to maintain its dividend even in the face of a much reduced oil price. In fact the gross gearing level of 26% is one of the best in the stock market…