At Mello Workshop 2015 I spoke about how to construct a high-yield portfolio and documented the process; in this article I create just such a portfolio and discuss some of the questions that arise while following the rules.

Introduction

In Part 1 of this article I discuss how to select a shortlist of shares suitable for a high-yield portfolio (HYP) and go on to chose the first fifteen companies. In this follow-up article I expand the portfolio to twenty-five shares and discuss some of the necessary decisions and compromises required with these smaller-scale businesses.

The spreadsheet of all shares considered for this HYP can be found here.

The portfolio (shares 16-25)

16) easyJet (Industrials - Passenger Transportation)

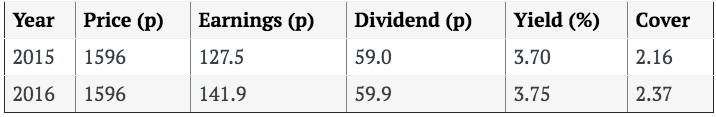

Once you're past 15 shares it can become tricky to find suitable candidates, in novel sectors, and creativity is required; hence my inclusion of Easyjet. The positive aspects of this budget airline are its size (£6.4bn), low gearing (32%), decent yield (3.8%), excellent cover (>2x) and double-digit annual dividend growth over the last 5 years (>30% per annum). The negative aspects are that, well, it's an airline (they always lose money don't they?) and the short history of payouts (just five years). These are certainly significant strikes against the company but on balance I think that it's worth gaining exposure to this growing sector and trusting that management will continue to execute profitably.

With the maiden dividend arriving in only 2011 it's important to check just why management started paying them (excess capital on the balance sheet it appears) and, more crucially, what their intentions are. Four years ago this was to "Target consistent and continuous payments", with a limit of "Five times cover, subject to meeting gearing and liquidity targets", and this remains true today. However improved performance means that the payout target has been lifted to: "40% of profit after tax pay-out ratio for ordinary dividend" with the possibility of special dividends to return excess capital. So it's clear that Easyjet intends to continue rewarding shareholders appropriately - in stark contrast to most other airlines.

Smiths Group is a global technology company that covers everything from healthcare to telecoms but that's not the major attraction here; what really captures my attention is a dividend history stretching back to 1994 with no cuts whatsoever. This suggests to…