The performance of Value in 2022

As 2022 nears completion, it will have been a challenging year for many investors. The full drama of the year isn't really captured by the FTSE100, which looks like finishing roughly flat on the year:

No Index is perfect. However, the FTSE100, packed with large cap global banks, mining and oilers, doesn't really reflect the average UK company. The FTSE250 is perhaps a better fit for this:

Here the bleaker picture is visible, with these more UK-focussed stocks down around 19%.

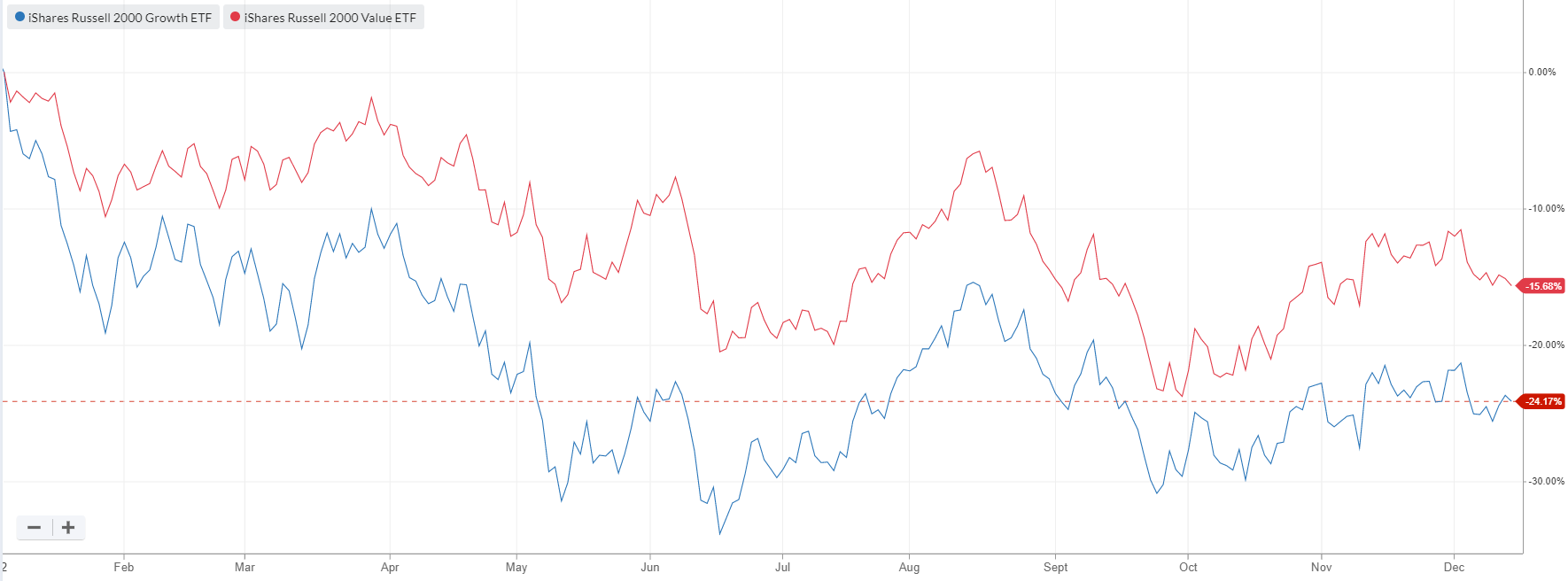

When it comes to assessing the performance of Value, I first look at the broader US market since this is the largest in the world and tends to lead global equity markets. Here the Russell 2000 Growth ETF has underperformed the Russell 2000 Value ETF by 8% this year:

So, this has been a year for the resurgence of Value. However, the Value ETF has not been immune to the weak markets and is down 16%. As the old stock market adage says: "you can't eat relative performance". So, this is unlikely to be a salve for the wounded investor.

Closer to home, the Stockopedia Value Ranks shows a similar story:

This was not a year to own the most expensive stocks, which are down over 40%. (I'm not sure there is ever a year for this!) However, even the cheapest stocks have underperformed the FTSE All Share Index. So, what is going on? It becomes clear if we look at only the largest of companies:

Only amongst companies with a market cap of £2.5bn or more did the cheapest decile of stocks beat the FTSE All Share. (It is even worse for the Quality and Momentum Ranks: none of the equal-weight deciles beat the market-cap weighted All Share Index) So 2022 has really been a year of rotation from large cap growth to large cap value but focused only on very narrow market sectors: commodities, defence and banking. Given that the average individual investor is unlikely to have a competitive advantage in these large cap companies, it is not unsurprising that they may be under-held amongst individual investors leading to underperformance…