One time I accompanied a senior analyst to meet the chairman of a company that was rolling out new units at pace. I was just out of university and what little knowledge I had of business came straight from the textbook. This was maybe my first chance to listen to actual professionals talk about the reality of running companies.

For the most part, I sat to one side, wide-eyed, watching the conversation like an owl and scribbling all manner of notes into my little book. Beneath the busyness, I was just happy to be in London, out of the office, and with someone else paying for my lunch.

The details of this meeting have faded with time but one exchange, which I’ll paraphrase, seems to stick. Towards the end of the lunch, the chairman turned to me and said: 'You’ve been quiet. You must have a question for me.'

I had several hundred, but I settled on one.

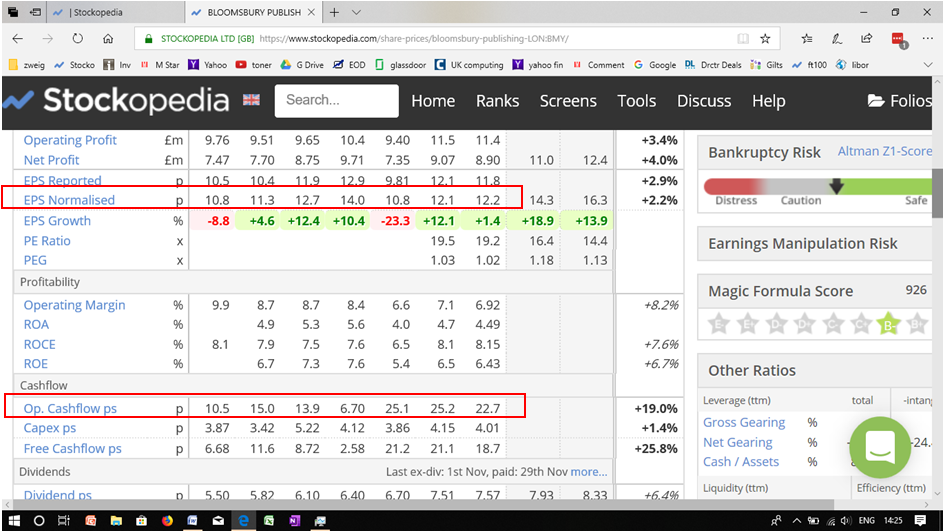

'With all these new sites, all these pre-opening costs and adjustments, which numbers do I look at to understand what’s really going on?'

To this, the chairman replied, 'Cash is king' - so I took his advice and checked the cash flow statement.

For investors wanting to hone in on the underlying picture, being able to navigate a cash flow statement is a must. Adding even just a few cursory cash flow quality checks into your investment routine - such as making sure that cash flow from operations routinely covers capital expenditure and dividend and interest payments - can help reduce risk substantially.

You can find my quick take on a cash flow checklist at the bottom of this article.

Different industries, different cash flows

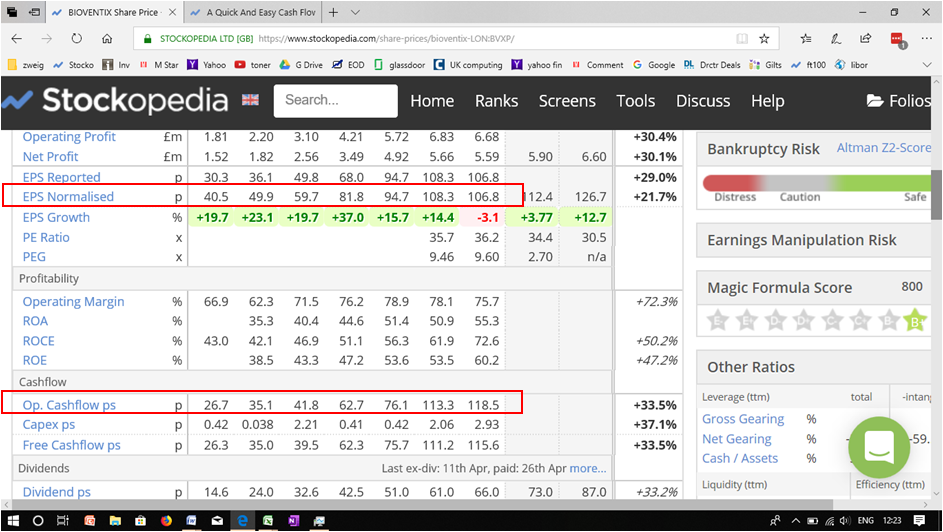

The cash flow statement should be evaluated within the context of the company’s industry and its corporate lifecycle.

Certain industries are capital intensive, like hotels, while others chuck off so much cash they don’t know what to do with it. All else equal, a cash generative company or sector will command a higher valuation multiple than one that requires vast amounts of capital expenditure - so this is an important business characteristic to be aware of.

Take two companies with roughly the same market capitalisation in different sectors, with vastly different cash flow characteristics: Restaurant Group (Hotels & Entertainment Services) and EMIS (Healthcare Equipment & Supplies). You can…

.jpg)