Here’s a small mind experiment. I’ve got two investments to offer you. They are almost identical in what they do and priced at a similar valuation, but the first (company A) is very profitable and spits off lots of free cashflow, while the second (company B) is losing money and requires constant cash funding through debt and share issues. Which company would you rather invest in? Clearly, only a madman would prefer to invest in company B. But I hope to show you that there are very many madmen around…

Quality & Value - uneasy bedfellows

Any rational investor should prefer investing in higher quality companies to lower quality companies. So he’s likely to bid up the price of higher quality companies to a premium valuation, while lowering his bids on the lower quality companies to a discount. In theory this is the way the market should work.

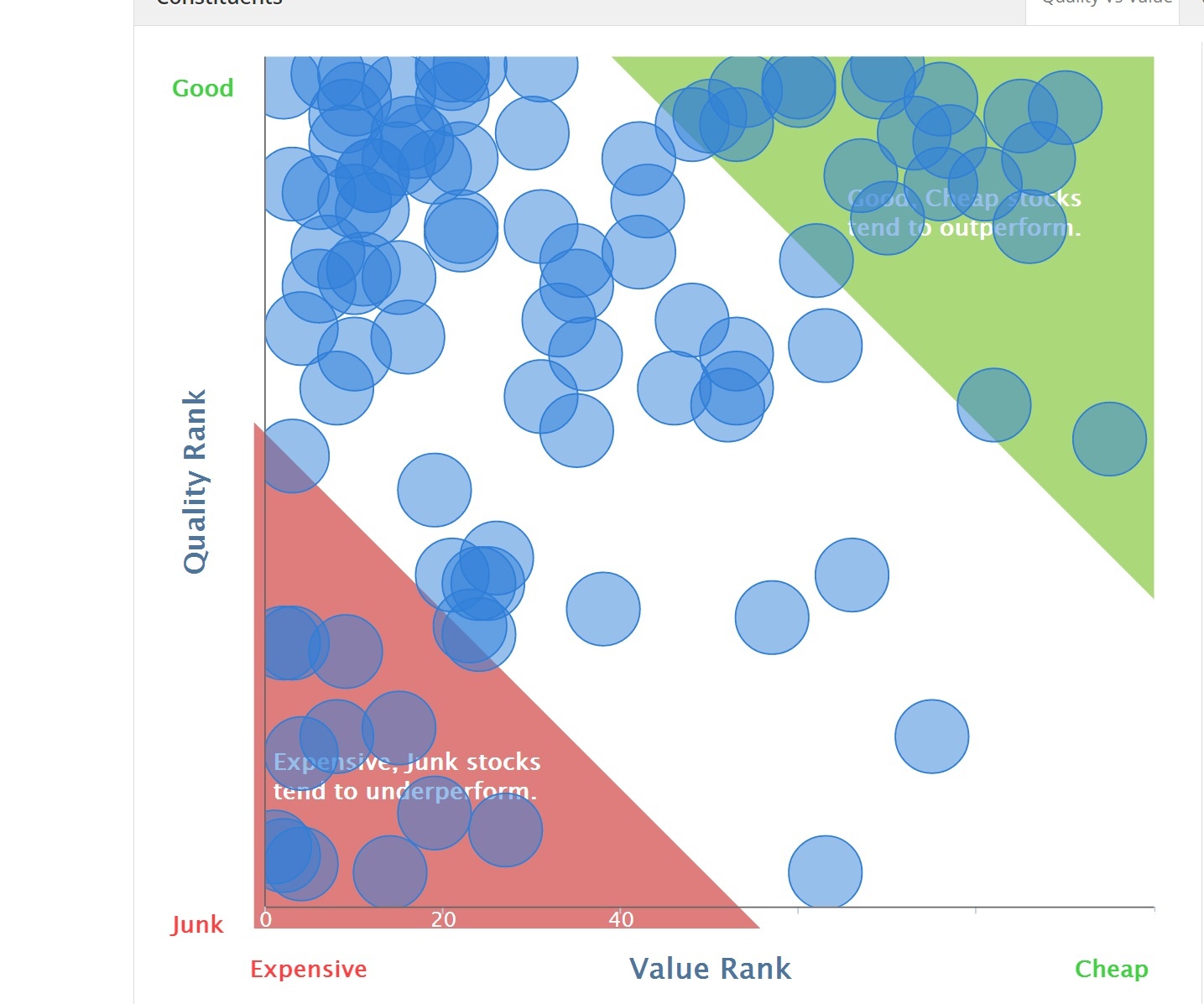

In order to investigate whether the theory holds true I’ve created a few scatter plots using the Stockopedia StockRanks. On the horizontal axis I’ve used the Value Rank, while on the vertical axis I’ve used the Quality Rank. These ranks score every stock in the market as a percentile from zero (worst) to 100 (best). So the cheapest stocks have a Value Rank of 100, while the most expensive stocks have a Value Rank of 0. Each blue circle on the plot represents a single company, plotted along each axis according to its own pair of rankings.

If we plot Value against Quality for UK mid and large caps (greater than a market capitalisation of £350m) we see a picture emerge.

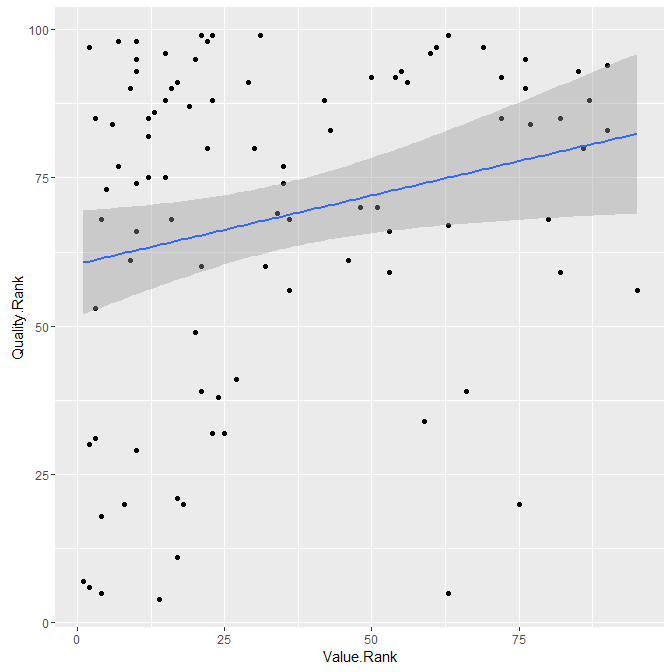

I’ve regressed a line on the above scatter plot to show the trend. It’s a weak trend, but it does back up our general thesis - that higher quality companies tend to be more expensive, while lower quality companies tend to be cheaper. The real holy grail in investing is finding high quality companies that are cheap (up in the top right corner of the plot), but the market is pretty smart and doesn’t give you too many opportunities there. In fact plenty of very successful value investors (such as Terry Smith of FundSmith fame, or the legend Warren Buffett himself) have learnt that paying up for Quality is one of the only ways to buy the best stocks in the market.…