Fast growing small-cap stocks have been in great demand since last summer. Some share prices have been electrified in the upbeat conditions - rewarding those who invested in what were hidden gems.

Growth stocks often fly when confidence is high. In the run up to ISA season this year it’s likely that these blistering gains will be catching the attention of investors looking to deploy funds. So in the search for these companies, what exactly should a growth stock strategy be looking for?

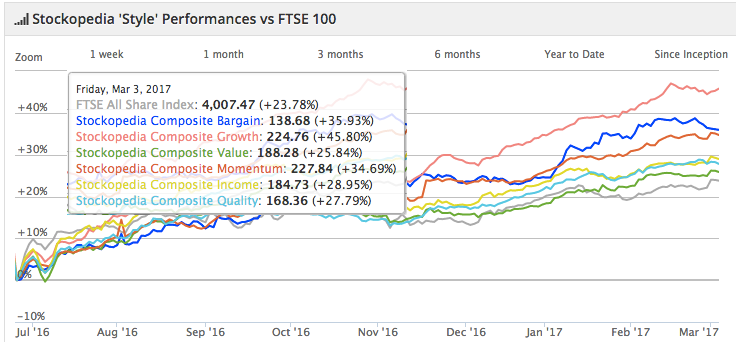

Several of the growth screens tracked by Stockopedia have notched up returns of well over 20%, and ever 30% over the past twelve months. They’re modelled on some of the most successful and closely-followed investors around. But for sheer pace and consistency in recent years, it’s hard to beat with the performance of a screen based on “rules” used by Robbie Burns, the Naked Trader (up by 36% pre-costs).

When I say “rules”, Robbie claims to me that he doesn’t really have any hard and fast rules. But what he definitely does have is a distinct style of investing that appeals to a lot of people. Look under the bonnet and you find a classic growth-at-a-reasonable price (GARP) approach that targets rapid growth but resists overpaying for it.

Growth investing strategies have been flying since the EU referendum

Rapid and reliable earnings growth

Like all growth investors, Robbie looks for a track record of historic profitability and the expectation that earnings will keep growing. Likewise, he uses sales growth and even dividend growth as a pointer to firms that are not only growing, but are confident that they can keep up the pace.

Modest debt is also a key feature here. Low or no gearing is highly desirable because debt is one of the biggest killers of small firms that are potentially vulnerable to deteriorating conditions. As a rule of thumb, Robbie Burns looks for net debt that’s less than three-times operating profit.

Growth at a reasonable price

Growth and value are occasionally seen as being at two ends of the investing spectrum, but GARP investors see thing differently. Typically this means thinking about how the market is pricing a stock’s earnings and profitability outlook. Racy multiples can point to frothy prices, which not only limits the upside potential but can also be a risk…