The potential for the current tension between the United States and China developing into a full-fledged trade war seems to be increasingly likely in recent weeks. Some people believe the situation justifies the moniker of “trade war” already. Others feel it hasn’t quite reached that degree of severity. Either way, although this topic potentially affects many people in many different ways, investors in particular might be concerned about the impact a possible trade war will have on markets.

That doesn’t necessarily mean they should be. First, however, it’s important to review the basics of the situation as they are right now. Keep in mind, this is a dynamic conflict, and details are constantly changing. Investors need to stay abreast of the latest developments to fully understand their significance.

Understanding the Trade War

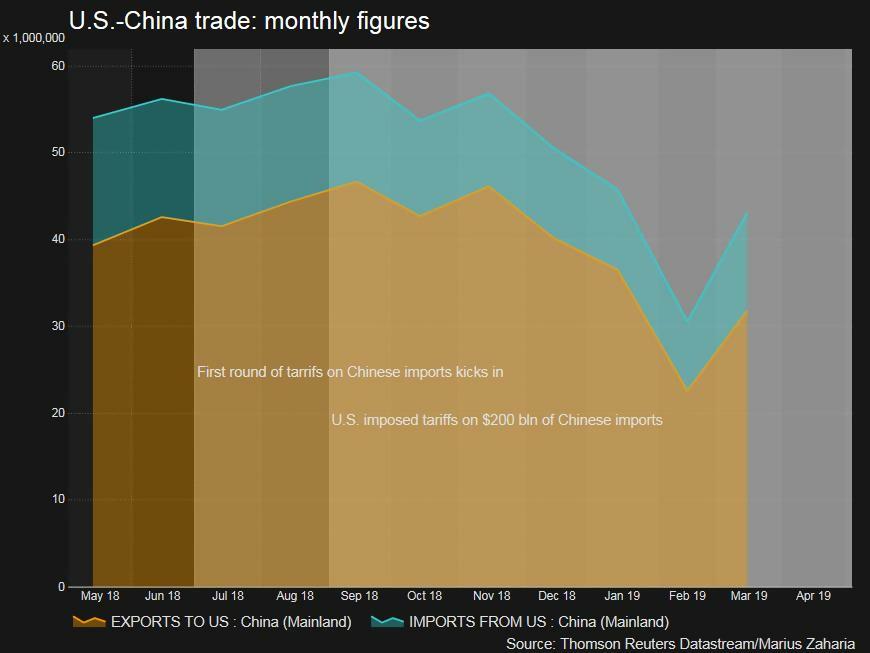

Hostilities began in 2017 when the US started investigating China’s trade policies and imposing new tariffs. At one point, when both countries agreed to stop imposing additional tariffs for a brief period, it appeared as though a deal may be struck. That unfortunately didn’t happen. In 2018, the US added more tariffs on greater than $250 billion worth of Chinese goods. China responded with its own new tariffs. This has yielded increased tension, with neither country appearing to give up much ground in the fight just yet.

The following image displays the recent developments in chart form:

In other words, it’s entirely understandable that investors might worry this escalating conflict will have substantial consequences. Two major economic powers locked in a trade war is rarely good news for the markets.

How the Fed May Help

Again, the above description isn’t meant to state that investor fears genuinely represent the future of the economy. Consider a recent statement made by Jerome H. Powell, the Federal Reserve chairman. On June 4, Powell, stated, “We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the US economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.”

It’s important to understand that such a statement is by no means a confirmation that the Fed will be willing to cut interest rates in order to mitigate…