Things, once set in motion, continue until influenced otherwise. We intuitively know this physical law and, thanks to research such as that by Jegadesh and Titman, are beginning to understand it better in the context of asset prices. Less frequently discussed, however, is the difference between two methods of measuring price momentum. The first, and most commonly used, is relative momentum – the momentum of a price as compared to other prices. The second is absolute momentum – the momentum of a price in relation to itself only. We rarely consider this in the physical world where we are naturally concerned with absolute momentum – after all, why would I care that one bullet is slower than another if it’s still going to kill me? When it comes to investing however, the two concepts can lead to surprisingly different results…

The problem with relative momentum

It’s the Olympics and you’ve won tickets to watch the long jump event. The competition is strong this time around and all competitors are performing well. So well, in fact, that you decided to spice things up a little and make a bet with your friend that before the event is up, a new world record will be set.

Above all others, one athlete stands out and is consistently putting in jumps at a level seemingly beyond the rest of the field. He’s the one, you think, as he steps up to the starting point for his final jump. Head down, he sprints for all he’s got, picking up more momentum than you’ve seen all day – this is it! He sails through the air with the best jump of the competition to seize the gold…but not the world record. As the athlete celebrates his victory, you hand over your hard earned cash and hang your head to reflect on where you went wrong.

The answer, you realise, was that you relied too much on relative momentum. In order to break the world record, the athlete didn’t just have to be better than everyone else on that day, but had to overcome an absolute level of performance.

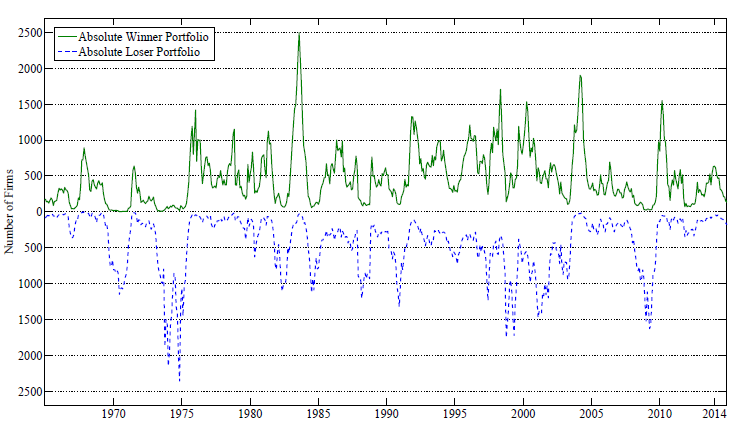

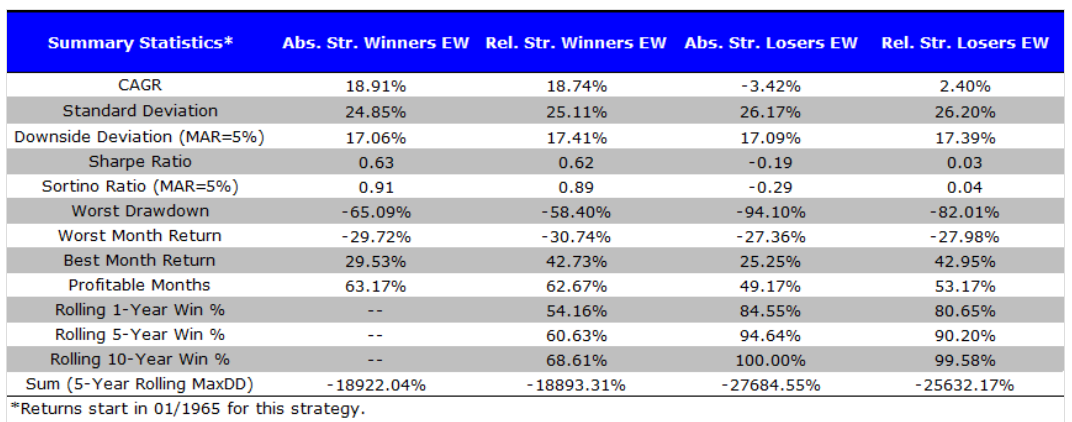

In the context of investing, this distinction may be key. In the midst of a bear market, the share with the best momentum may still exhibit negative momentum! By sticking to a relative momentum strategy we are prone to buy stocks with poor momentum in times of market duress, with unpleasant implications for…