The Adventurous Growth investment style lends itself to high aspirations.

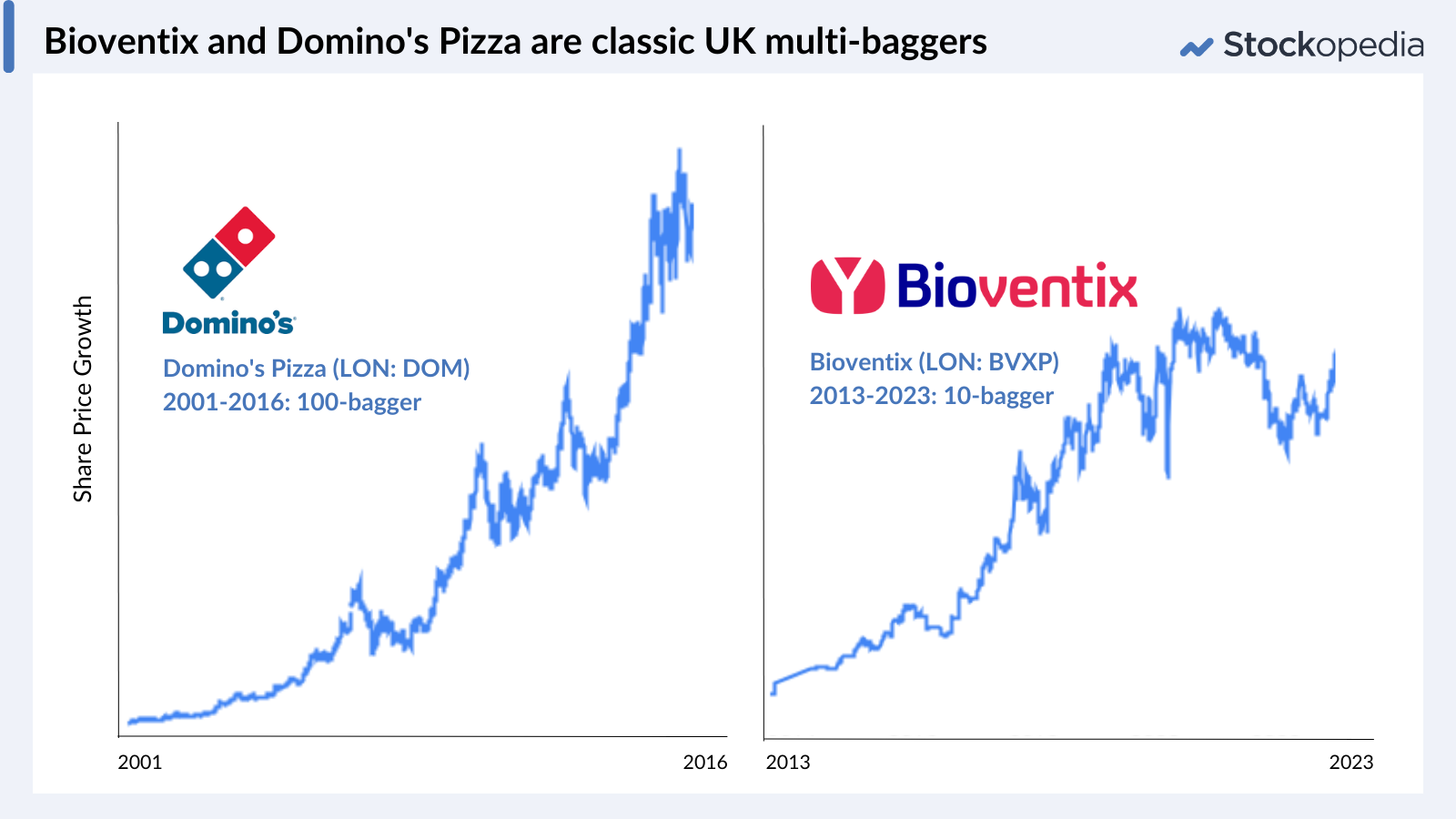

For a start, there are the anecdotes. How many of us have heard tale of the private investor who bought Domino’s Pizza or Bioventix soon after their respective IPOs?

Then there are the stars of the strategy, whose success is something that we would surely all like to replicate. Peter Lynch, for example, who retired at the age of 46 having managed a portfolio which generated annual returns of 29% over 15 years. And Bill O’Neil whose success in growth investing made him enough money to buy himself a seat on the New York Stock Exchange at the age of 30 - the youngest person ever to do so.

And let’s not forget the profile of the stocks which fit into this style of investing: multi-baggers (a Peter Lynch term which defines a stock that returns more than 100%). These companies are leaders in their field, they are doing something new and exciting and they are capturing headlines for both their intrinsic growth (driven by the quality factor) and their share price (momentum factor).

But for every promising stock which flies to multi-bagger status there are many more which flop. Adventurous growth investing is therefore not for the faint-hearted. This guide will:

- Help you understand what it takes to be a successful growth investor

- Explain the fundamental drivers behind growth investing

- Introduce you to some successful growth investing strategies

- Help you formulate a growth investing strategy which works for you

Are you a growth investor?

There is no doubt that all investors, regardless of their mindset, want the same outcome from the stock market: to make money. But the process by which they go about profiting from the stock market can be divided roughly into two camps: those who hunt for value and those who hunt for growth.

But there is nuance in those camps which means that the investor mindset from value to growth is more of a spectrum than a clear defining set of principles. At one end are the deep value investors who seek companies whose shares are currently trading below their intrinsic value, regardless of what that intrinsic value might be. These investors rely on mean reversion - that undervalued shares will eventually revert to the mean and become fairly valued. It’s a highly successful method for stock picking,…