Hi All,

I’m hoping to get some advice if anyone would be so kind! I have posted something similar in the “Trading U.K stock market using Mark Minervini strategy” thread but it looks to have been archived.

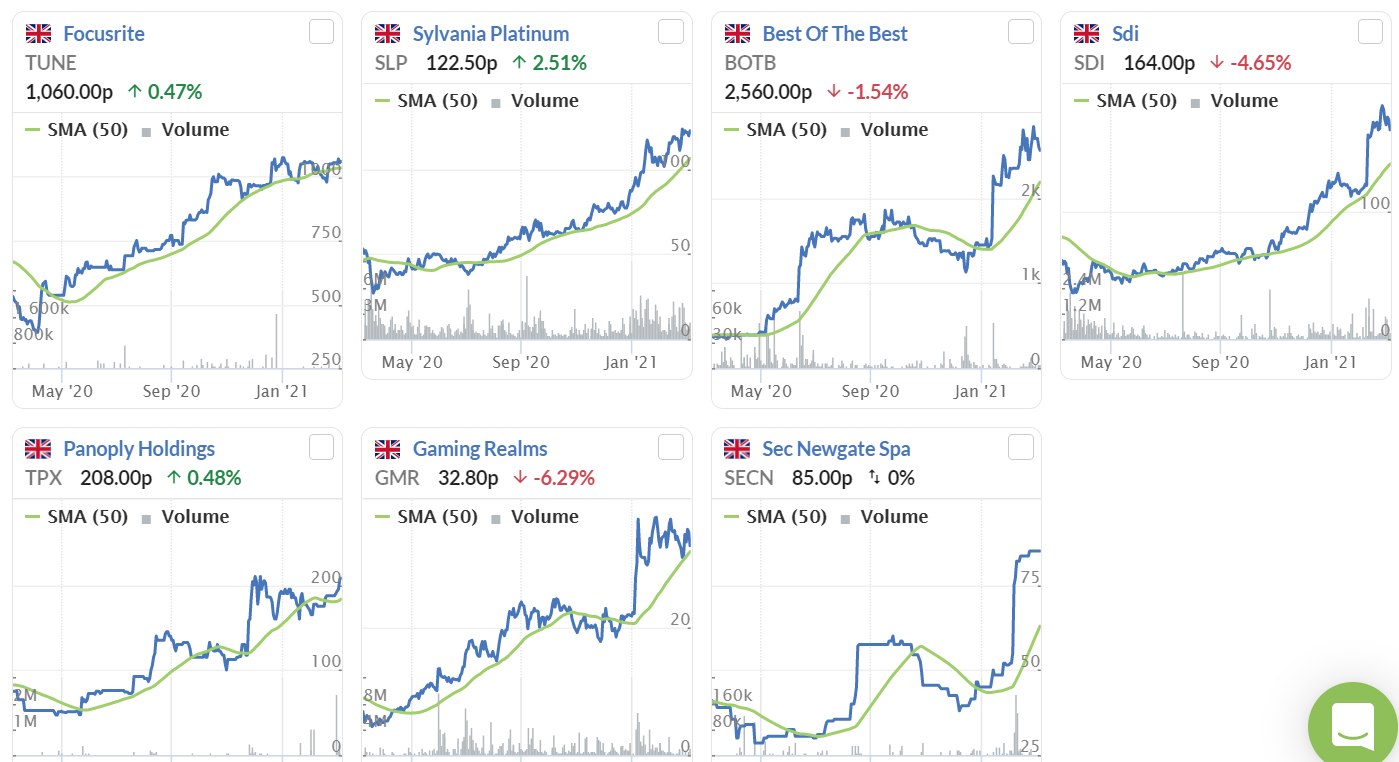

I’ve historically been an investor vs trader, but having read a lot of books, the Mark Minervini trading style (influenced by Weinstein and ONeil whose books I’ve also read) seems to make the most sense to me. I like his combining of technical analysis (triangulating price trend, high probability chart patterns, and volume analysis) with traditional fundamental analysis (picking strongest performers in strongest industries with improving results), with strict risk control.

I have therefore recently started trading the UK market using the Minervini approach. My initial performance is poor (I’d use expletives if I could – but guessing a moderator would block this post if I did!).

Most of my stock selections have been Small Caps and AIM stocks, thinking they would offer greatest upside (a £100m turnover company can double it’s turnover quicker than a £1billion turnover company), however the Market Makers seem to whipsaw me out of trades frequently. Then there are the spreads to contend with, which turn say a 5% stop loss into a much larger loss.

Based on my recent experience I have some specific questions if anyone with experience with this approach would be so kind to help a newbie out!

- Are there particular UK stocks that you flat out avoid, i.e. based on average trading volume/liquidity, based on industry, based on size i.e. market cap no less than X, based on exchange, i.e. no SETSqx Market Maker stocks, based on spread no larger than X?

- Do you use the Minervini strategy on UK stocks as your main trading strategy or are setups too infrequent?

- Do you trade as soon as breakout occurs intraday using volume confirmation by extrapolating volume during the day so far. Or do you trade at the end of the day when you are sure the breakout has held (but not extended by say x% from the buy point) and volume has confirmed the move.

- Do you place stop losses into the market on stop orders good till cancelled, or do you monitor the market with alerts to tell you when to sell out.

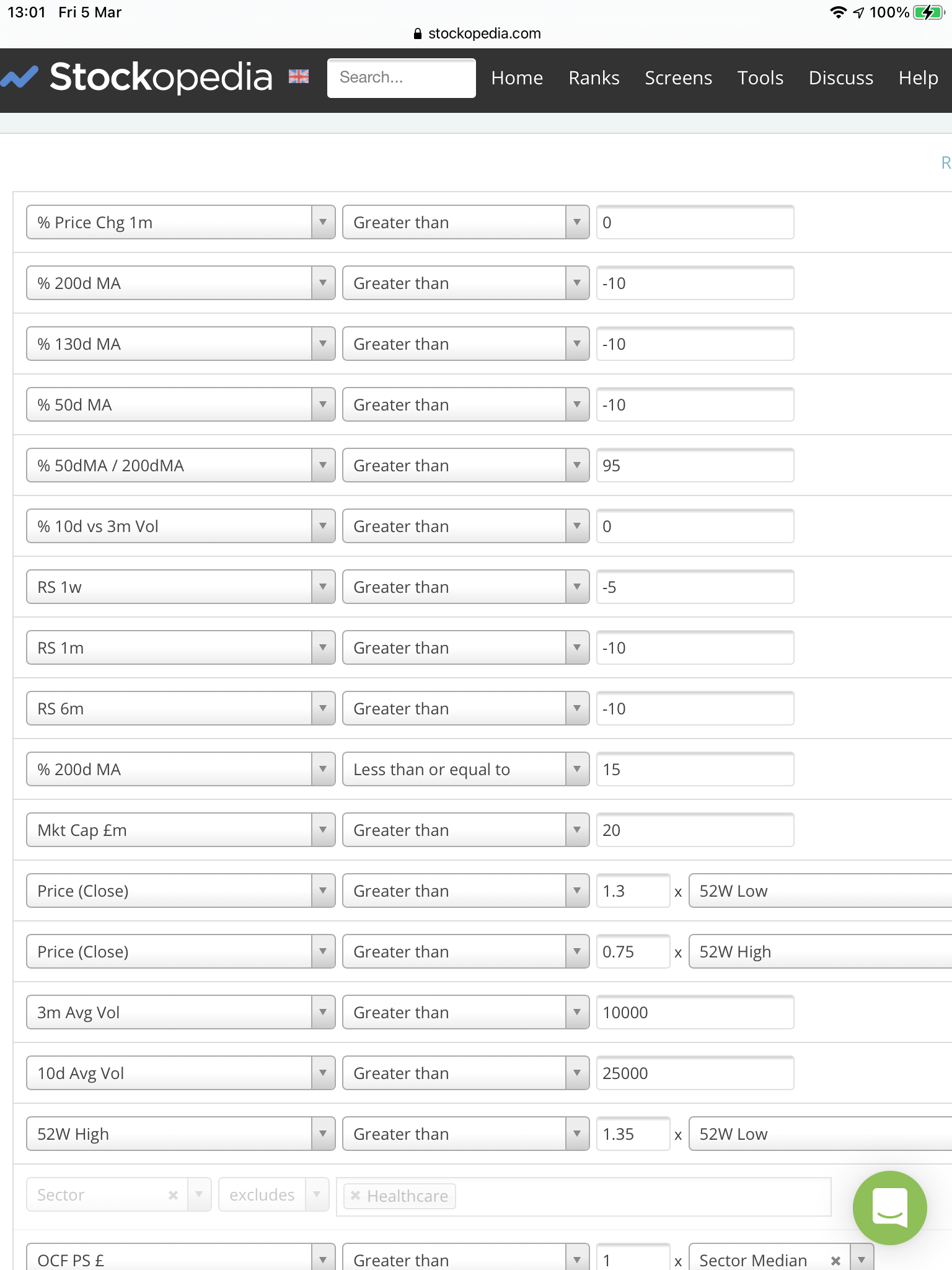

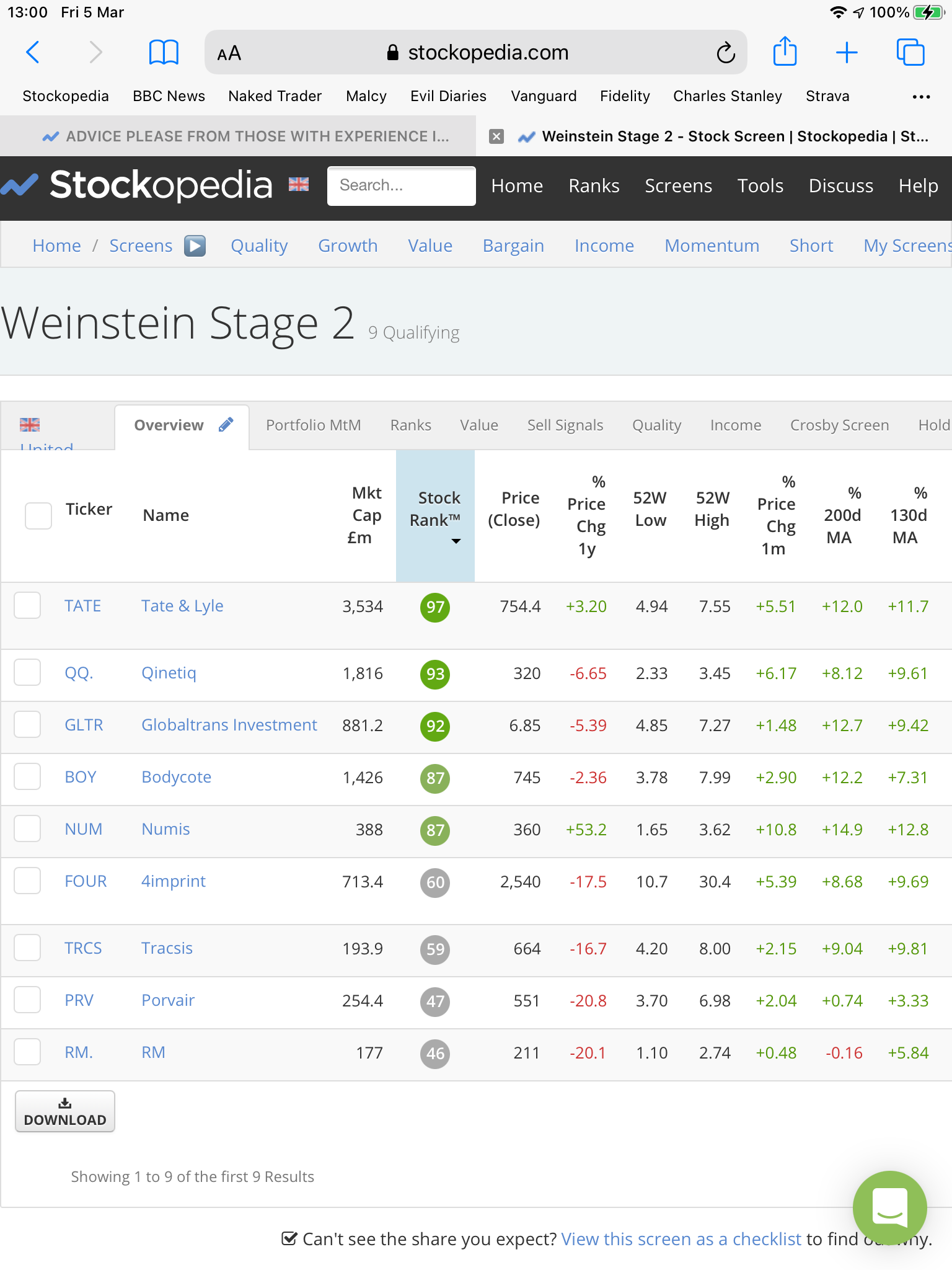

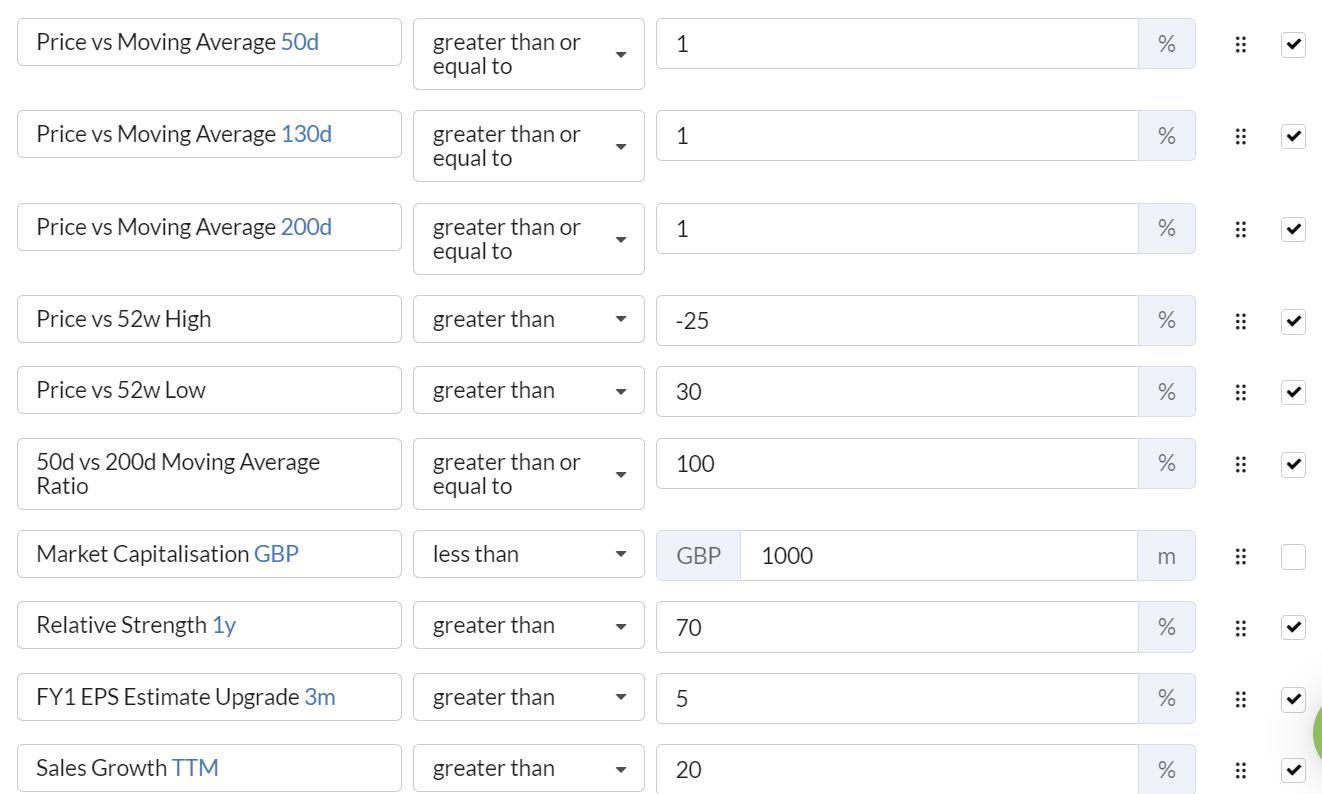

- How strict are you at applying the Minervini selection criteria?

I feel that the trading style should work…