KPMG says the merger and acquisition boom is back in 2015. Certainly, company takeover activity has been hotting up on both sides of the Atlantic these past few months – just think of Shell swallowing up BG in oil and gas, Nokia merging with Alcatel-Lucent in technology and FedEx buying up fellow Dutch logistics group TNT Express.

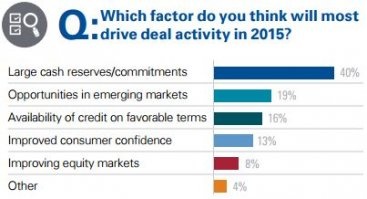

Figure 1. What factor will drive deal activity in 2015?

Source: KPMG 2015 M&A Outlook Survey Report

One of the main reasons for expecting more takeovers is the very high level of cash that large companies are holding, and the very low interest cost on company debt (Figure 1). With money burning a hole in corporate pockets, top executives want to go shopping for growth.

In trying to predict who could become the next takeover targets, we need to know the profiles of existing targets: which industries are seeing the greatest number of takeovers and takeover rumours, and what size of company is most likely to be susceptible to a takeover approach?

Technology, healthcare, media, insurance and oil and gas are ripe for consolidation

I see four industries as prime hunting grounds to search for potential takeover targets, given recent takeover and merger activity in recent months:

Technology: Nokia is merging with Alcatel-Lucent in telecoms equipment, while US set-top box maker Arris is buying UK set-top-box maker Pace (LON:PIC) for $2.1bn.

Healthcare: In generic drug making, Israeli global leader Teva has bid some $40bn in cash and shares for US generic drug rival Mylan. Novartis, the Swiss drug maker, has revealed recently that it is hunting for healthcare acquisition targets in the $2bn to $5bn range.

Media: AT&T's acquisition of DirecTV in the US and Liberty Global's purchase of Belgian media company De Vijver Media NV highlight the consolidation occurring in the US-dominated broadcast media industry, with media content becoming increasingly valuable to cable and TV distributors.

Insurance: Lloyd's of London insurers has been the focus for acquisition of late, with both Catlin (LON:CGL) and BRIT Insurance (LON:BRIT) bought up by larger North American insurers. We can also add the merger of close-end life assurer Friends Life (LON:FLG) with

Already have an account?

Unlock the rest of this article with a 14 day trial

Login here