I'm still relatively new to investing in individual stocks, as I'm learning I'm fascinated (frustrated?) by the price movements of some AIM stocks I hold.

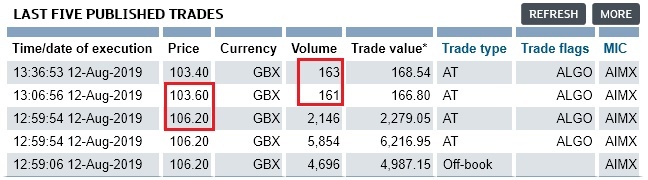

What I'm noticing is a fairly large swing in price on very little volume. Here's an example from today - a 3p swing (down) on volume of under 200 - this pattern repeated multiple times today already (i.e. on each movement up, the price is abruptly brought down by an 'A' trade on very little volume).

I'm not overly concerned, and accept this is all likely fairly normal - however, any insight that anyone can offer to help me understand 'how MM's work' would be appreciated.