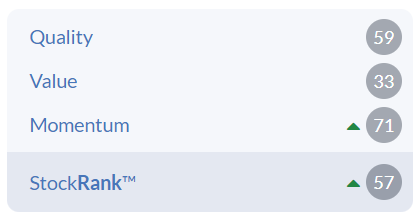

For this ‘fundamental’ view on a stock, I delve deep into the depths of the smaller cap realm. It's an ‘emerging’ story that still carries elevated risks, as evidenced by the moderate overall StockRank score. These risks however seem to be moderating as the business continues its growth trajectory and hence why it has been put forward for discussion.

ASX:ALC Alcidion Group

Alcidion (ASX:ALC) assists healthcare organisations by delivering a platform which helps with patient care delivery through clinical decision support, artificial intelligence and real-time visualisation health informatics. These insights extend the full scope of patient care though to organisation management.

Miya Precision is the flagship product, and it is built on a Fast Healthcare Interoperability Resource (FHIR) standard for sharing healthcare information in a compliant manner which helps with patient management. The short description, it is a patient management system for hospitals and medical facilities.

A more simple explanation is that the platform is plugged into the electronic medical record system of a hospital and Miya helps by running clinical decision support algorithms in response to changing clinical data. There are also a range of other products and services that run from the core technology, adding scope to increase stickiness and penetration into a facility.

ALC has customers in Australia and New Zealand, but another real key driver is its more rapid expansion into the UK following the acquisition of Silverlink and ExtraMed over a year ago. While Australian companies have had a chequered history when it comes to investing in the UK, today the businesses have been fully integrated and ALC ended FY22 with at least one product in 39 NHS Trusts (there are 219 in total).

The numbers for ALC currently look like they need clinical treatment themselves. However as with all companies with a market cap of $200 million, hope springs eternal.

From the end of 2021 the stock has fluctuated, mainly on account of momentum 'rise and falls'. Though it finished 2021 with a StockRank score of 46 and it is now 57 so that is an improvement. Investors will be hoping the fundamentals can now do more of the heavy lifting.

Keen observers will note that the company has been a consistent loss maker, however if the two brokers that cover the stock are to be…