In the short term, spread betting on the S&P 500 Index can seem a risky occupation. But in the longer term, it’s no more risky than investing in an S&P 500 tracker ETF such as £VUSA . And it has the advantage of lower costs plus the benefits of margin and guaranteed stop losses if required. A bet of £1 a point requires a margin of about £210 and costs around £1 per quarter. The minimum distance for a guaranteed stop loss is only 10 points with some brokers.

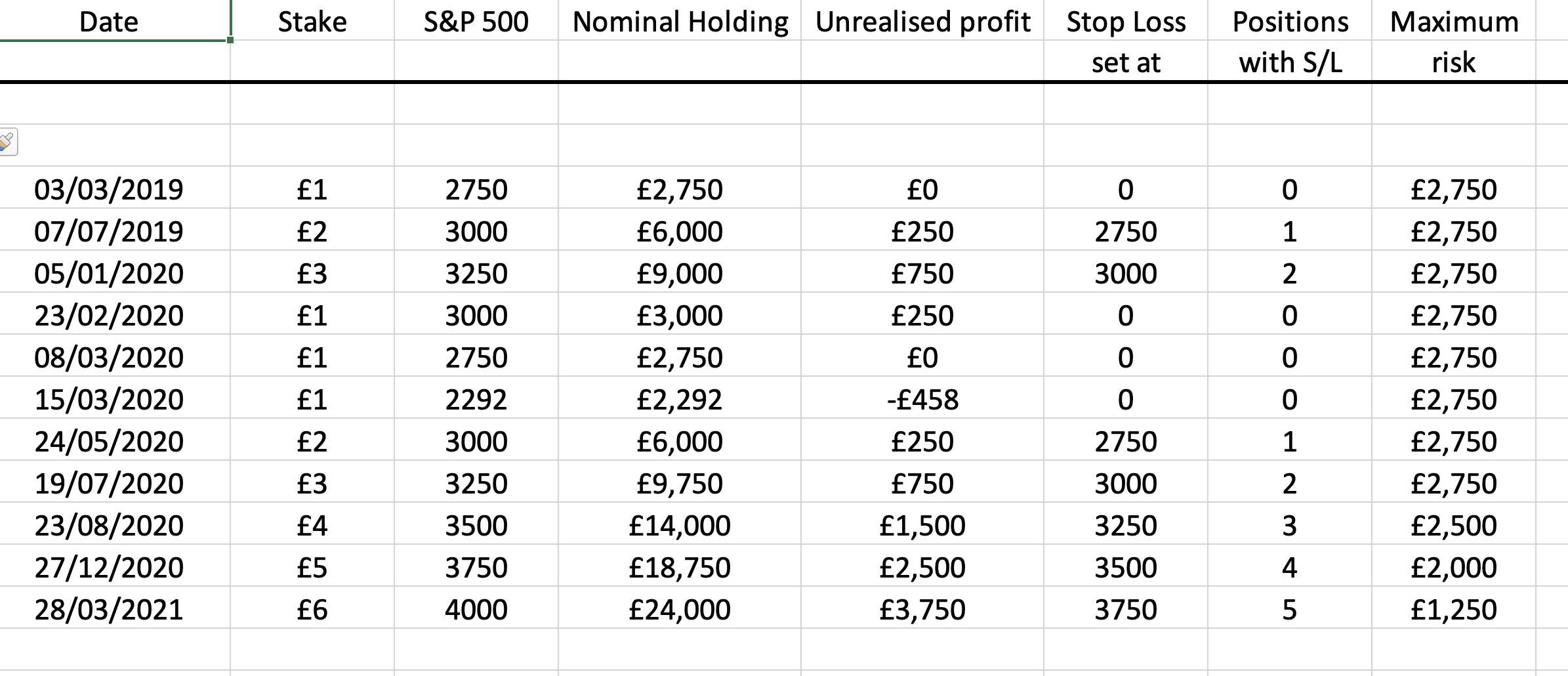

As a mathematical exercise, I have produced a spread sheet of a spread bet model showing how it is theoretically possible to maximise returns from an initial stake of a £1 a point by increasing the stake by £1 a point each time the index rises by 250 points.

Risk is managed by setting a stop loss on the second bet at the entry point of the first bet. When the index rises another 250 points, the stop loss for the first and second bets are set at the entry point of the second bet (and so on with each further rise of 250 points). Please note I don’t use a stop loss on the newest bet although this is just a matter of personal preference. The reason for this is that the newest bet might get stopped out too quickly. The bettor accepts the risk of a £1 bet having no stop loss or else places a stop loss well away from the opening zone, otherwise the whole process might have to start again from scratch.

It will be noted on the spread sheet below that the first date is 3rd March 2019. This shows what happens to the bet as it approaches the Covid crash of February/March 2020 and what happens as the S&P 500 recovers. The maximum drawdown is £458 and the unrealised profit on 28th March 2021 is £3,750. This represents a 136% return over 2 years against an initial hypothetical risk of £2,750. Some patience is required as the system does not start to make a substantial profit until about 18 months after the initial bet. For bettors in a hurry, the incremental intervals could be reduced to 100 points, but this would result in a much larger number of stop outs, and restarts.

There are other ways of…