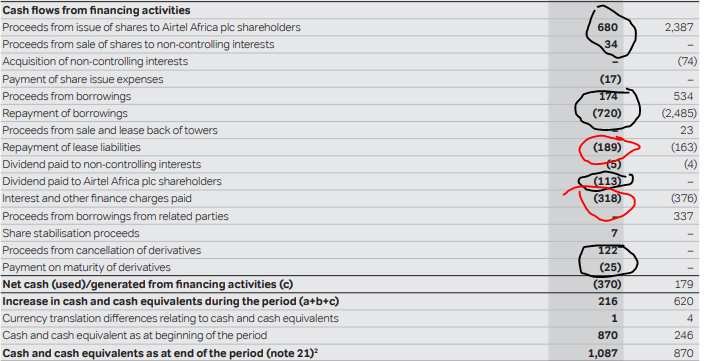

OK - so this is the black sheep of my portfolio - the worst performer by far and a share that I have (probably stupidly) bought more of recently to bring down the average price (to 39p). I have a painfully generous chunk of my overall portfolio allocated to this one. Its also the share I watch and research the most.

As far as I can see, weakening African currencies make this the biggest risk, and perhaps a prolonged impact of Corona in Africa. I also see that many investors might be put off by the majority shareholder parent company. However, they seem to be positive in nearly all other aspects, especially increasing revenues, and paying off debt and operating in some of the fastest growing markets in the world (population and economies). Couple that with a fat dividend, and I am really not sure why these are so out of favour. Everyday, I watch the price trying to rise before it is pushed down again. Is it the flight of investors from Africa in general, including Unit Trusts that might invest in Airtel Africa (LON:AAF)? Is there anyway to see who is selling/shorting?

Your views would be much appreciated.