Whether or not a company’s shares are a good investment will depend on what you’re looking for. In my case I want my investments (which match those in the UKVI Model Portfolio) to produce higher total returns than the general market (i.e. the FTSE All Share), primarily through:

- Having a higher dividend yield at all times

- Growing the dividend income faster than inflation and faster than the market

- Growing the capital value in line with the growth of the dividend

To achieve this I focus on buying shares from a diverse group of large, high quality businesses. Each of those businesses should have a long history of increasing profits and dividends, and the share price should be low relative to the earnings and dividend payments of the company. You can find out a bit more about this strategy here.

This review will show whether or not BG Group’s shares are up to those standards, whether they’ll only be considered at a lower price, or if they would never be considered because the company just isn’t good enough.

Overview of BG Group

BG (LON:BG.) is effectively one half of what used to be British Gas; the other half is Centrica. BG Group kept the ‘upstream’ business involved in the exploration and production of gas, while Centrica took the ‘downstream’ activities of supplying gas and electricity to retail customers.

BG is a large company, with a market cap of more than £36 billion. That puts squarely at the top end of the FTSE 100. It has over 6,000 employees working in more than 20 countries, and describes itself as a ‘world leader in natural gas’.

From an initial glance this is clearly the sort of large, diverse and market leading company that I like.

Starting with the company’s accounts

As usual I’ll start this review with the company’s accounts. Ultimately it doesn’t matter how much you like a company, or how well it’s positioned within its market – if it isn’t producing a steady stream of growing sales, profits and dividends, it isn’t doing a good job for shareholders.

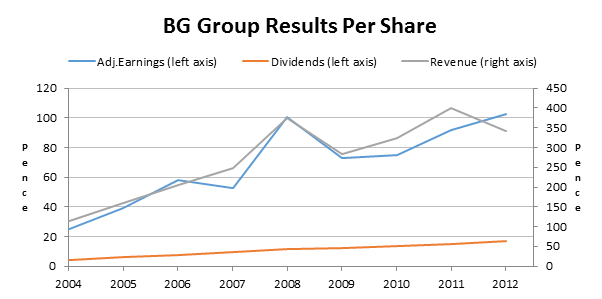

You can see the results that BG Group has achieved for shareholders during the last decade using the key metrics of revenue, earnings and dividends per share.

I think the best way to find companies that have…