Today, we will focus on the macroeconomic connection between levels of interest rates and the stock market. Interest rates are very important tool in the hands of central banks. They use them to impact money supply and to stimulate or cool down the national economy. They are tightly connected with the level of inflation and affect markets. It is common knowledge, that low-level of interest rates mean cheaper debt for companies. If the companies can get cheaper financing, they take it and invest in development. Investments are good for the economy and strong economy is good for the markets. When the condition of national economy is wrong and there is a threat of deflation, the central bank must intervene, because of their inflation target. On the other hand, when inflation is to high, interest rates are lifted and it will probably cool down the economy.

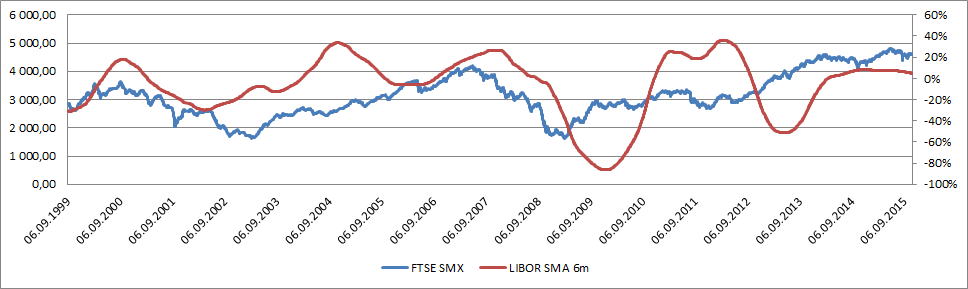

Let's see how these changes affect the market. In our analysis we will base on LIBOR GBP 3M (as one of the many counted interest rates) and as before, on FTSE SMX (why we choose this index is explained in previous article). We think, that very high interest rates are not good for the investors, because they could be a sings of coming bear market. To prove it, we have measured and smoothed changes in LIBOR (6 months simple moving average of LIBOR changes yty), which are presented as LIBOR SMA 6m and show this on the one chart with FTSE SMX index. Results are presented below:

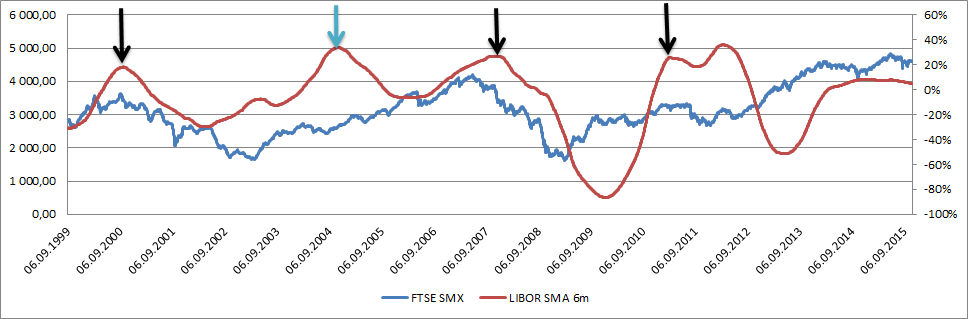

We can see, that LIBOR SMA 6m varies from -80% to almost +40% and some correlation can be found. We have 4 peaks and they are marked on the chart below. 3 black arrows present peaks, after which we experienced falling FTSE SMX. In two cases, they appeared almost simultaneously with the peak of the index and in one case after this. The blue arrow shows peaks, which did not indicate bear market.

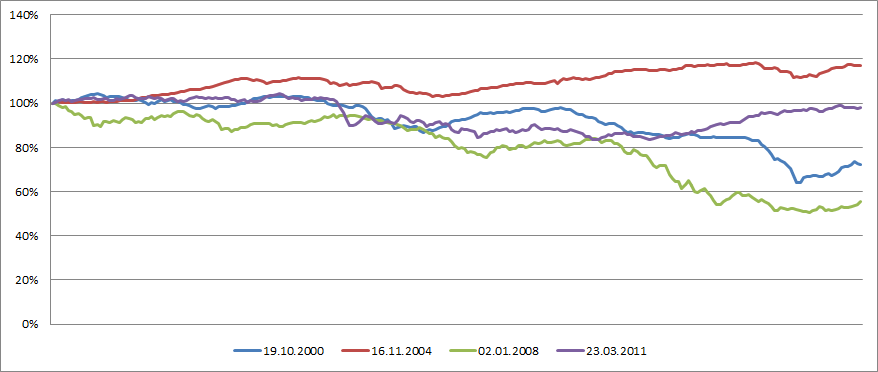

Now, let's check how strong are these signals. We distinguished the exact date of each peak and check, how FTSE was changing during one year after this event. Chart below shows how much the index fell or raised: