Diageo PLC is the world’s leading premium drinks business. Even the most teetotal of investors are likely to have heard of its brands such as Guinness, Smirnoff and Johnnie Walker.

And those brands are really the crown jewels of the company. They give it the power to move into new regions and out-sell other drinks by leveraging the integrity of those famous names.

Given the rapid emergence of the global consumer class, that’s a very useful power to have.

Rapid, high quality growth driven by emerging consumerism

It’s a familiar story, one in which owners of strong brands like Burberry, Reckitt Benckiser and Diageo have benefited from throughout the last decade and in some cases far longer.

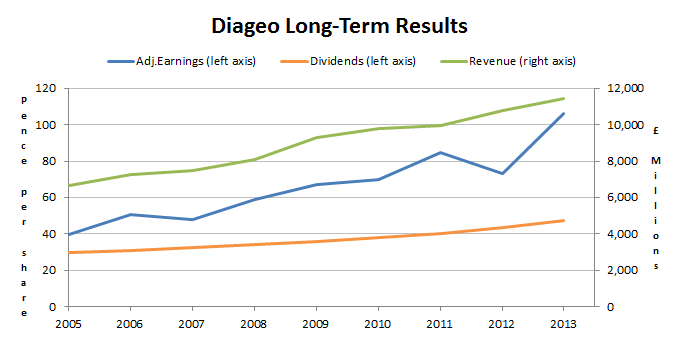

More people gradually (and not so gradually) being lifted out of poverty and suddenly wanting to brush their teeth with Colgate, clean their bathrooms with Cillit Bang, drink Guinness or wear Burberry. It’s a bandwagon that’s been rolling for a long time and you can see how Diageo has made the most of it below:

The company has grown by about 8% a year in the last decade. That’s way beyond the somewhat anaemic 2% that FTSE 100 companies have managed on average.

And it’s been pretty steady growth too. The dividend has been nicely progressive, increasing in every single year, while revenues and earnings have increased smoothly too, making it virtually impossible to see any impact from the financial crisis of 2007-2009.

It’s not all sweetness and light however. The company does have £10 billion in debt, although interest payments are covered almost 10 times over.

£10 billion is also just 3 times my estimate for the company’s average earnings over the next decade, and I consider a debt to future earnings ratio of anything less than 5 as reasonably prudent.

And then there’s the £400 million or so it recently had to pay to reduce its pension deficit from over £1 billion, or the £25 million it is committed to paying into the pension fund each year for the next decade.

Even so, if you want an example of a defensive company you won’t find one much better than this.

It’s exactly the sort of low risk, dividend paying company I like to own, but of course only at the right price.

High multiples, low yields, but still pretty good value for money

If you look at Diageo in terms of dividend yields and PE…