National Grid PLC is the company that owns and operates the electricity and gas transmission networks in England and Wales. It’s listed on the FTSE 100, has a market cap of around £28 billion and has paid a consistently growing dividend for many years – but does that make it a good buy with today’s share price at 746p?

As well as owning and operating transmission networks, National Grid also owns energy generation facilities in the US, operates (but doesn’t own) the Scottish transmission network, and is involved in various other activities that relate to getting energy to consumers and businesses.

Choosing your investment criteria

How you value shares depends on what you’re after. If you’re after triple digit gains in a year and are willing to risk a total loss, then a speculative mining company may have a certain value for you. If, on the other hand, you are after a steady dividend income, then the value of a speculative mining company is essentially zero.

I’m a defensive value investor, which to me means aiming for steady growth of income and capital by investing in quality companies at attractively low prices. Specifically, I want to invest in companies that have:

- Consistent, above average records of growth

- Strong balance sheets

- Relatively large, preferably international operations

- High dividend and earnings yields

- Good future prospects

Let’s see how National Grid stacks up under those criteria.

Past financial performance

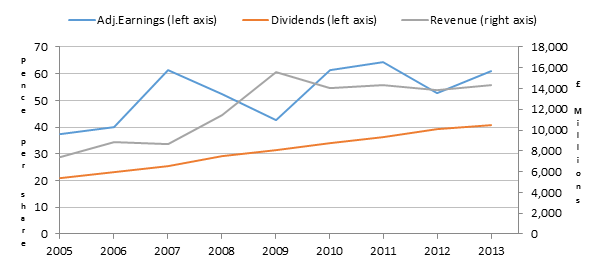

In the chart below you can see how the company has done in recent years.

It’s easy to see that the company has had some pretty solid results, especially given the unexciting and perhaps even dull industry in which it operates.

Consistently high historic growth rates

Growth has averaged around 7.5%, with dividends growing at closer to 9%. Despite somewhat volatile earnings, the general upward trend is clear and relatively consistent.

Strong balance sheet

This is an area where National Grid stumbles to some extent. As a heavily regulated monopoly operator in the utility industry, it is virtually guaranteed revenue, profits, cash and growth. On that basis it may be acceptable for the company to carry more debt than would be prudent for a company that was not a monopoly.

In this case National Grid carries something like £28 billion in debt. That is a lot by almost anybody’s definition. Interest payments…