We thought we’d try out a few smaller stock pitches, in the same style as 12 Stocks of Christmas. Hopefully you find it interesting! ASAI is a stock I strongly considered for my annual watchlist this year, so I thought I’d write this up to give it a sort of “honourable mention”.

Disclosure: At the time of publication (16 Jan 2026), I did not have a position in ASA International. I subsequently initiated a personal position on 20 Jan 2026.

The Pitch

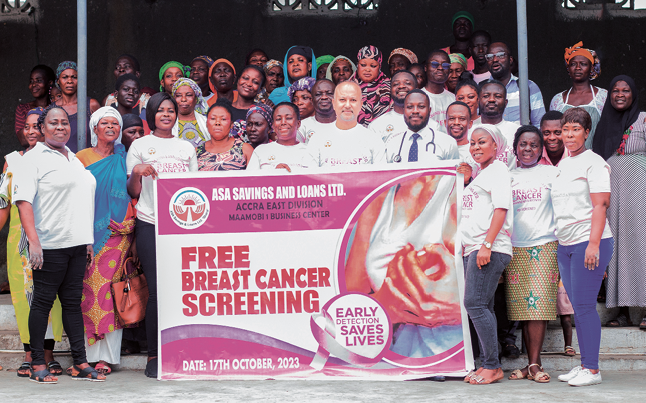

ASA International describes itself as “one of the world’s largest microfinance institutions”. Headquartered in Amsterdam, it provides “socially responsible financial services to low-income entrepreneurs, most of whom are women, across Asia and Africa”.

The company was founded in 2007 and quickly spread from the Philippines to Sri Lanka, Ghana, India, Pakistan and beyond. Today it operates in 13 countries.

Recent financial results have been very strong, with after-tax net income rising to $29.2m in 2024. $48m was forecast for 2025, but the company informed us in December that it would significantly exceed this amount.

The Big Picture

For a company with such a low market cap, it has some impressive figures:

2.5 million clients with an average outstanding loan across clients of just $182.

Geographic diversification: as noted above, it offers geographic diversification across various countries and regions. The 2024 annual report showed 2,145 branches with about 30% in South Asia, 23% in South East Asia, 22% in West Africa and 26% in East Africa. While single-stock exposure to just one of the countries in these regions might signal a high-risk investment, this balanced exposure helps to reduce the risk profile.

Founder led: the co-founder Dirk Brouwer is also the largest shareholder and was the CEO until June 2023. He is currently the Non-Executive Deputy Chairperson. His shareholding appears to be c. 32% currently. Of course there is always the risk that this turns into a stock overhang at some point, and according to our shareholder analysis feature, his holding has reduced this month.

What The Brokers Say

The stock is covered by Cavendish (many thanks to them), and they put out the following updated forecasts for FY25 and FY26. The FY25 profit forecast was increased by a remarkable 31%, and the FY26 profit forecast was increased by 25%:

…

.JPG)