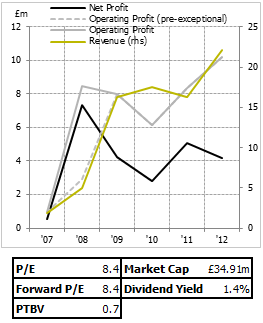

After Dart's rather spectacular success recently, I'm casting my eyes over a rather less beloved aeronautical stock - Avation, the £35m market cap aircraft leasing company. I should note that a company being unloved, in this sense, is almost a prerequisite for it being an interesting investment. That was exactly the position Dart found itself in a few years ago - a company thinly traded (though not as bad as this one) and with a rather lowly apparent valuation, and explains both my and Richard Beddard's slight unease at a company which has gone from that position to being far more discussed, tipped, followed and - more importantly - richly valued. Still, I'll come to Dart in a later post.

After Dart's rather spectacular success recently, I'm casting my eyes over a rather less beloved aeronautical stock - Avation, the £35m market cap aircraft leasing company. I should note that a company being unloved, in this sense, is almost a prerequisite for it being an interesting investment. That was exactly the position Dart found itself in a few years ago - a company thinly traded (though not as bad as this one) and with a rather lowly apparent valuation, and explains both my and Richard Beddard's slight unease at a company which has gone from that position to being far more discussed, tipped, followed and - more importantly - richly valued. Still, I'll come to Dart in a later post.

Avation is an interesting group to me particularly because valuing it should be quite easy. An aircraft leasing company does something very simple in the world, and there's not a huge amount of room for differentiation. Their role, it appears to me, is twofold. Firstly, they allow companies to shift some assets off balance sheet. I suspect this is an attractive proposition, but also appears to be one that's liable to come to an end in the next decade with improving rules on operating lease accounting. That's far from the only value they provide, though - more importantly they allow for everything that's positive about leases generally. They allow companies to expand more rapidly than they otherwise could, without the need for huge amounts of capex up front. They also mitigate completely the risk related to holding an asset which depreciates fairly quickly (at least compared to the other big ticket leased asset that comes to mind, property).

I don't know how liquid the market is for second-hand aircraft, but if we assume it is fairly liquid, valuing Avation should be easy. After all, the operations are soothingly straightforward - they buy an aircraft, financed with debt and equity, pay interest on the aircraft over the next x years, lease the aircraft over the x years, and then can either sell the aircraft at the end, lease again if it was for a short term and so on. Since their customers - big airlines (notably Virgin Australia) - will nearly always have the option of buying the aircraft themselves, their isn't much room for predatory margins. If/when they acquire reasonable…

.png)