BAE Systems is one of the bluest of blue chip stocks you could imagine: It’s big, it’s defensive and it has a dividend yield of more than 4%. It sounds like the perfect choice for a high yield portfolio.

That’s a fair summary of how I used to view the company, which is why its shares have been part of my portfolio since 2011.

But times have changed and these days I’m less upbeat about BAE’s shares.

A relatively defensive company in a defensive industry

As you’re probably aware, BAE Systems is Europe’s largest defence company and the world’s third largest. It’s listed in the FTSE 100 and has a market cap of almost £16 billion, so it should satisfy the size demands of even the most ardent large-cap investor.

It’s also a relatively defensive company.

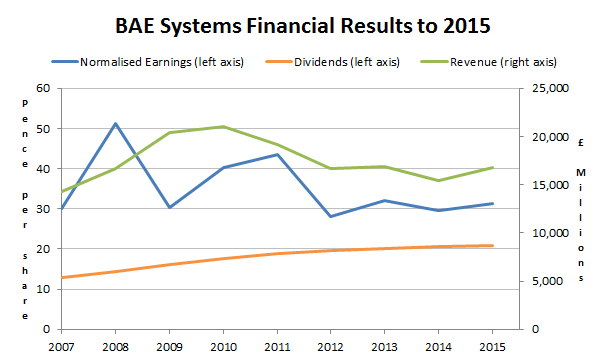

It operates in the Aerospace & Defence sector, which is defined as defensive in the Capita Dividend Monitor, and its financial results (shown in the chart below) also suggest that the company is relatively defensive in reality as well as in theory.

Although the company’s results are relatively defensive, the chart tells the story of a company which has effectively flatlined in recent years, although that isn’t entirely the company’s fault.

Due to the nature of the financial crisis governments had to cut their defence budgets; as a result BAE’s revenues and profits have gone nowhere, although the dividend has continued to progress (albeit very slowly).

Average financial results and an average valuation

In numeric terms the company’s long-term financial results as compared to the FTSE 100 average are:

- 10-Year growth rate = 0.7% (FTSE 100 = 2.0%)

- 10-Year growth quality (i.e. consistency) = 75% (FTSE 100 = 50%)

- 10-Year profitability = 9.2% (FTSE 100 approx. 10%)

In this case I’m assuming that BAE’s past growth is a good indicator of its future growth potential, which is an overly simple but usually reasonable starting assumption.

To see if BAE’s share price represents good value for money we can look…