When I bought Balfour Beatty in 2011 the company was still performing well despite some obvious headwinds in the UK and US due to recession-like conditions and government spending cuts in both countries.

I thought the company stood a reasonable chance of getting through the slowdown without major problems, and for a couple of years that was true. Eventually though Balfour became more risky and existing risks, which I hadn't spotted, began to have a serious impact.

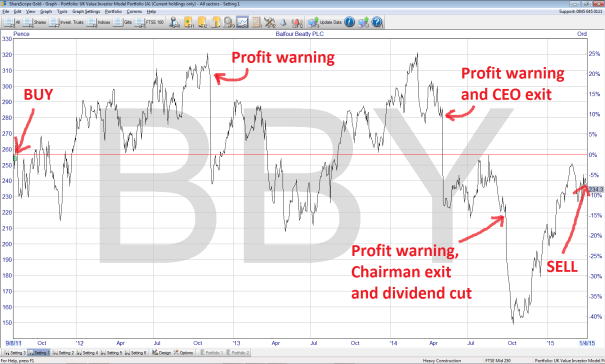

A few days ago I sold Balfour from both my personal portfolio and the UKVI model portfolio and Balfour has become the first defensive value investment that I've sold at a capital loss. After dividends are included it still produced a positive return, but not a particularly good one.

| Purchase price 254p on 09/08/2011 | Sale price 232p on 07/04/2015 | Holding period 3 Year 8 months |

| Capital gain (after fees) -9.7% | Dividend income 18.6% | Annualised return 2.6% |

Those are the raw numbers, but I think the chart below does a better job of showing how “eventful" this investment has been over the last three years or so.

Click to enlarge

So the investment did not work out well which, in and of itself, isn't the end of the world. Underperforming investments are a fact of life that active stock pickers must learn to live with.

However, it is important to carry out a detailed autopsy into all past investments, especially bad investments. The idea is to extract the right lessons, improve your investment process and avoid making the same mistakes in future.

Buying an established business with a solid track record

In 2011 Balfour appeared to be having an impressive run of success. It had a long-term Growth Rate of 12.1% (for a definition of Growth Rate and the other ratios I use, see the stock screen page and scroll down) and had increased the dividend in every one of those years.

It didn't have a great deal of debt (just £44m of operational borrowings, which gave it a Debt Ratio of 0.3) and had about half of its business operating on either side of the Atlantic, which seemed to give it some degree of protection from declines in either the US or UK markets.

Here are Balfour Beatty's financial results up to the 2010 annual report, which was the latest at…