Barratt Developments (LON:BDEV) are one of the shares that have been with me the whole last year and a half since I formed the portfolio. While my approach has changed - clearly vastly for the better - they're one I've stuck with, and even bought more on their significant dip a little way in. My original premise was completely oversimplified but I still think there's merit in it; essentially, I bought because it was trading at something like 35% of book value. Something I gave nowhere near enough credit to at the time was how book value was actually calculated. It sounds obvious, but as a rookie I put too much faith in the financial statements - something that had me come a cropper in other investments later on.

Barratt Developments (LON:BDEV) are one of the shares that have been with me the whole last year and a half since I formed the portfolio. While my approach has changed - clearly vastly for the better - they're one I've stuck with, and even bought more on their significant dip a little way in. My original premise was completely oversimplified but I still think there's merit in it; essentially, I bought because it was trading at something like 35% of book value. Something I gave nowhere near enough credit to at the time was how book value was actually calculated. It sounds obvious, but as a rookie I put too much faith in the financial statements - something that had me come a cropper in other investments later on.

As safe as houses

The fact is, the valuation of inventory, work in progress, land with development potential etc. isn't quite as black and white or clear cut as I first assumed. Given the huge amount of impaired land Barratt had on their books, this is fairly critical. Even impaired land though, assuming it's been impaired 'perfectly' to its recoverable value, is nothing like similar to un-impaired land; impaired land sits on books at recoverable amount. You only have to look at the margins the company earns on land bought and impaired at different timings to see how the total carrying value has read-through problems to future cashflows. There are a lot of other bits of information to need to really know the true economic value beyond that one figure.

This is something I vastly underestimated - and didn't particularly understand. Frankly, the exact accounting still isn't something I'm hugely comfortable with. I'm getting better; such is the value of writing and practicing - but it means I should treat my own judgements with a large dose of skepticism. Hopefully this comes through in most of my posts; rarely am I hugely confident. It is a balancing of odds, or an attempt to do so.

Where we stand now

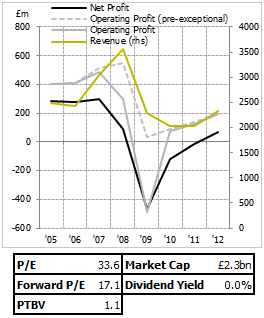

With Barratt now, then, we've passed the point where my original investment idea becomes irrelevant - we're now a bit over tangible book value, instead of 40% thereof. That means it's been a big success for the portfolio - I bought at about…

.png)