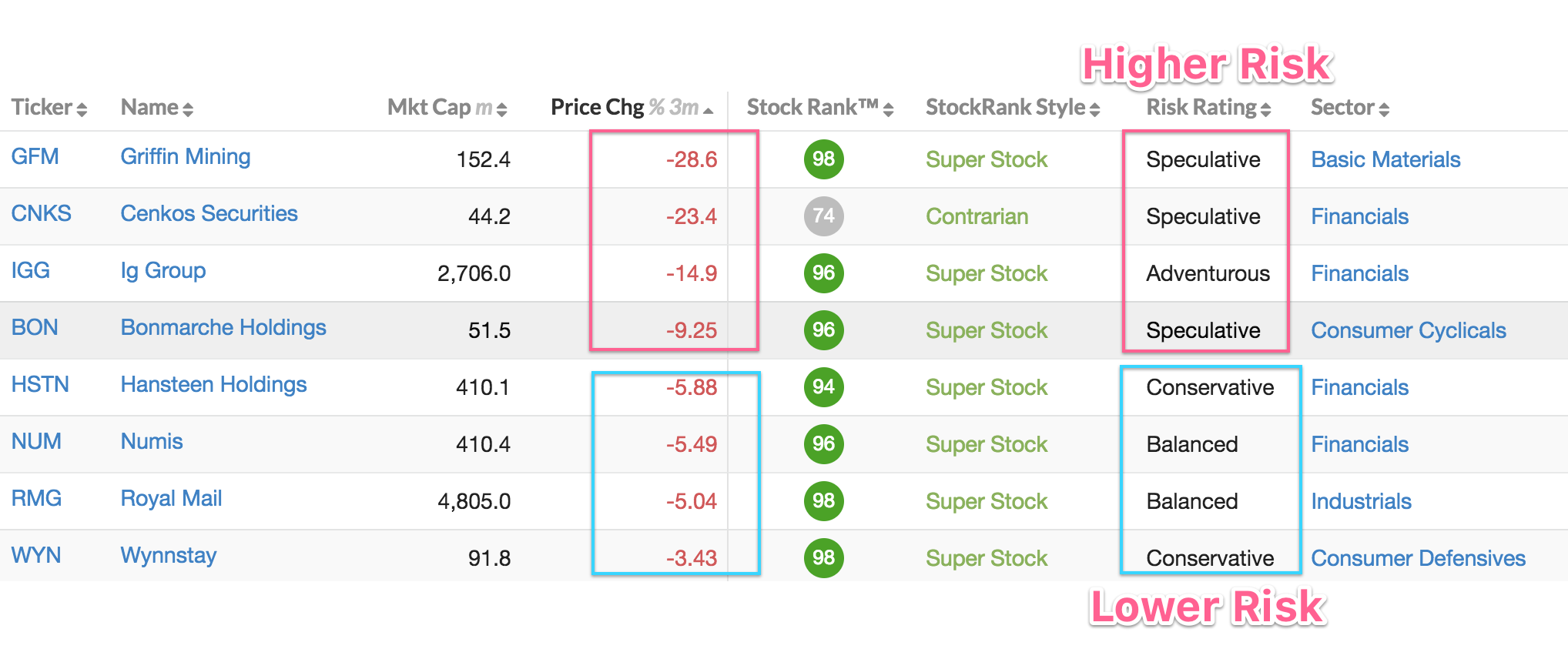

I am following a high stock-rank screen which tends to pay dividends. I have been beaten by the markets recently with the whole portfolio down by 11% in last 3 months.

Cenkos down 30%

IGG down 25%

Bonmarche down 25%

Griffin Mining down 30%

Royal Mail down 15%

Numis down 15%

Wynnstay down 10%

Hanstten down 10%

All these shares had a SR of 99+ when I bought them about 2 months ago.

I hope this is the 1/3 of probability of picking losers from the high stock ranks is playing out!

Thanks for posting. May I ask how you decided to pick these stocks? Did you do research too, or was this based on stock screening? My comments on the stocks you mention:

Cenkos Securities (LON:CNKS) - I used to hold these but dumped them on recent trading. I don't know why you would still be holding these, the last results were shocking.

IG Group (LON:IGG) - I don't know why people would be holding onto spread betting firms at the moment, the tighter regulations are obviously affecting the trading of many of these firms now with subdued trading and outlook statements from a number of them. Oh, I've just read that the CEO is stepping down too... not a good sign.

Bonmarche Holdings (LON:BON) - I so very nearly bought them after the previous update... but I am glad I didn't. Their trading updates seem to swing from positive to negative like a yo-yo and they are always blaming the weather. The retail environment is shocking at the moment, I wouldn't invest in retail stocks at all... though I do have one existing holding in QUIZ (LON:QUIZ) which on balance I am okay with after the latest update.

Griffin Mining (LON:GFM) - the last results were not good, there is still no interim dividend, the Zone II saga goes on and on, and the prices of all of the metals that they mine are looking weak. At this point, I also have to ask you whether you have a stop-loss strategy? If so, surely this would have kicked in by now...

Royal Mail (LON:RMG) - I don't have anything particularly scathing to say about them, but they are now in a very competitive environment.

Numis (LON:NUM) - the results and updates have been very good, but they have had a very good run of late. I'd guess that they are down on profit taking and on worries over the UK market performance as a whole.

Wynnstay (LON:WYN) - I have considered an investment in these, however the momentum is fairly poor and their history is rather chequered, so I am staying on the sidelines. They are also weather-dependent too, owing to farming supplies.

Hansteen Holdings (LON:HSTN) - I think they are down after a recent sale deal was terminated. The interims look reasonable, but the dreaded word "solid" is mentioned in terms of occupancy. Overall I think they look okay, and are now trading below NAV. But I am invested in others in the sector, some of which I am disappointed with and others more positive on.

I have just posted a lengthy comment on the NAPS post and will reiterate a point from that on here - I don't think one can blindly invest purely on Stocko ranks and stats, these must be a starting point for further investigation. Griffin Mining (LON:GFM) is a prime illustration of where this strategy is seriously flawed, in my opinion.

I hope all my comments help..