A year ago, I noticed that Stockopedia’s Dividend Dog screens had been outperforming the market by a comfortable margin since late 2022 – broadly speaking, when interest rates started to rise.

I created a model portfolio to test whether this outperformance would continue – and to see how much income it could generate in a market where risk-free yields were over 4%.

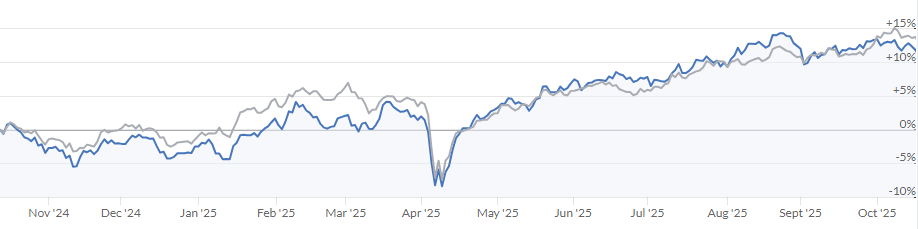

One year later, the initial results are in. This simple high yield strategy has almost matched the FTSE 100 on share price gains…

… but it’s beaten the index when dividends are included:

| Period: 15/10/24 - 15/10/25 | Share Price Return | Total Return (share price + dividends) |

|---|---|---|

Dividend Dogs | 12.4% | 19.8% |

FTSE 100 | 14.2% | 18.3% |

While the total return outperformance is only 1.5%, it’s worth remembering that the Dividend Dogs portfolio generated an income of 7.4% over the year, compared to just 4.1% for the FTSE 100.

For investors interested in generating a natural income from their portfolio – withdrawing dividends without selling stocks – I think this could be an attractive result.

Certainly I am sufficiently encouraged to refresh the portfolio and keep it running for another year. Before I look at the updated stock selection though, here’s a snapshot of how my selection from last year performed.

2024/25 Dividend Dogs review

To create the portfolio, I merged the results of Stockopedia’s two Dividend Dog Guru Screens:

Dividend Dogs: uses trailing 12-month dividend yields

Dividend Dogs (Forecast): uses rolling 1-year forecast yields

I chose to do this mostly because it provided a larger and more diversified result set than relying on either screen alone.

In terms of historic performance, the historic Dividend Dogs have outperformed the forecast Dogs since the screens’ inception, but the pattern of performance has been fairly similar.

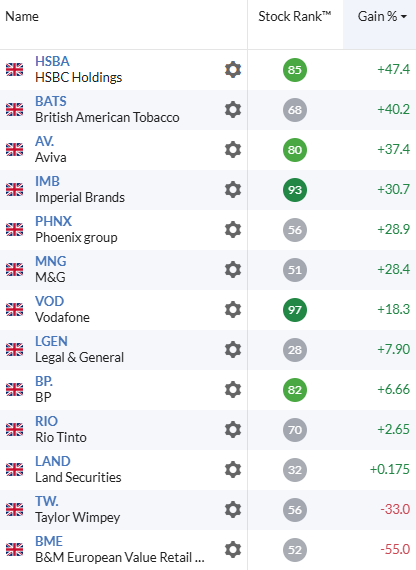

I ended up with 13 stocks in last year’s portfolio. While this is below the 15-20 I’d ideally target, I think it was enough for a useful experiment. Here’s how they performed last year:

I would not have predicted this set of outcomes at the start of the year (I was relatively bullish about the biggest loser, B&M European Value Retail SA (LON:BME)) – but that’s the nature of this kind of investing. Shares…