Berkshire Hathaway released its annual report over the weekend. Warren Buffett doesn’t say much new, but perhaps that is the point... He and Munger have been explicitly telling us for decades how they make their money. It is up to us to apply some of those lessons.

After a false start in textiles, Berkshire found success by growing the “float” of its insurance operations and using that upfront cash to invest in high quality, compounding businesses. These companies earn high returns independently, but the way in which they are brought under Berkshire’s umbrella is itself a source of strength. You might call it a moat - according to Buffett: “Berkshire’s positioning of its “controlled” businesses within a single entity endows it with some important and enduring economic advantages.”

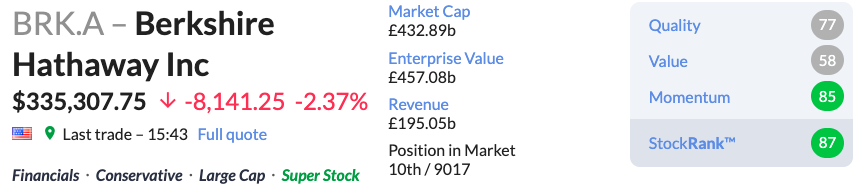

It’s a highly successful model that has seen Berkshire become one of the biggest companies in the world, with a single “A” share worth as much as a house and a market cap of some £433bn.

In many ways, Berkshire is the blueprint for quality. Warren Buffett’s annual letters to shareholders are required reading for many.

On the 22nd of February, Buffett’s 2019 Shareholders Letter was published. Here are some key takeaways.

1. Retained earnings: the common stock’s superpower

Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it - Albert Einstein

Early on in his career, Buffett transitioned from a value investor to a quality investor. This evolution was prompted in part by serious troubles in his early businesses. In the 2019 letter Buffett says: “When we acquired control of [Berkshire’s original textile business] in early 1965, this beleaguered operation required nearly all of Berkshire’s capital. For some time, therefore, Berkshire’s non-earning textile assets were a huge drag on our overall returns.”

What looked cheap at first ended up consuming vast amounts of capital.

The low returns on capital you often find in “cheap” stocks mean they miss out on a unique characteristic of equities: stocks are the only asset in which a part of your return is reinvested for you. With Berkshire, this is typically invested in operating assets, acquisitions of companies or stakes in listed companies, and share buybacks.

This redeployment of growing capital is an extremely valuable mechanism for compounding gains. Charlie Munger, who is one of the most widely-read…

.jpg)