No doubt most investors are feeling bruised as a result of what is proving to be a pretty ferocious stock market drawdown. Even good companies are getting hammered.

Such conditions do provide long term opportunities, though, as Mr. Market presents us with new prices every day. Those good companies are just as high quality as they have ever been, it’s just now they are cheaper than they were a couple of months ago. Now more than ever it’s important to identify the best stocks to invest in because the odds are we will get chances to buy at good prices.

On first glance, Best Of The Best (LON:BOTB) shows some signs of having what it takes to be a long term winner. It has a clean balance sheet. Its revenue and profits have been growing consistently for years. It has a QM Rank of 98. It generates consistently strong returns on capital and chucks off cash, which is reinvested in growth opportunities or returned to shareholders. The founder still runs the company and owns nearly 50%.

These are promising early signs.

It looks like there will be significant disruption to certain parts of the economy as a result of measures to prevent the spread of Coronavirus. I imagine a lot of Leisure & Travel companies are registering some pretty steep like-for-like revenue drops right now, for example. Other companies will be less affected by these measures, and this is where there might be some opportunities.

The key driver of growth for BOTB is its evolution into a purely online host of weekly skill-based competitions. I think this could make it reasonably well insulated from the challenges other parts of the market are facing.

The story so far

Ever since 1999, car enthusiast and BOTB CEO and founder William Hindmarch has been busy building a cash generating machine - and, with a market cap of just £37m, I reckon there is still plenty for BOTB to aim for.

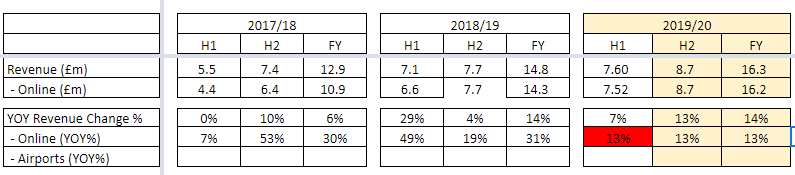

The group’s core business is in running car competitions. Once upon a time you would find them in airport terminals and shopping centers but the world has changed and now these competitions are online.

There is a lot to like about this company from a financial and shareholder perspective. A well run operation is one thing though. What makes BOTB interesting now is that it has a big…

.jpg)