There has been a lot of discussion recently regarding Best Of The Best (LON:BOTB) (which I hold), so I thought it might be useful for interested parties if I carry on the discussion here.

Below I've worked through cost and revenue assumptions, and included my own personal forecasts.

I would be interested to hear from others who hold or have an opinion on either my workings or the future of the company in general.

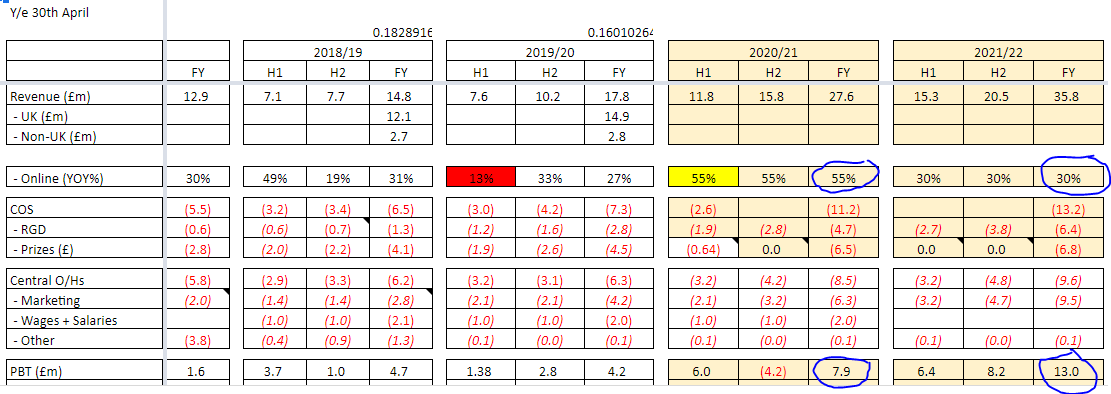

COST ASSUMPTIONS

Fortunately there are only 4 main costs and these can all be reasonably estimated.

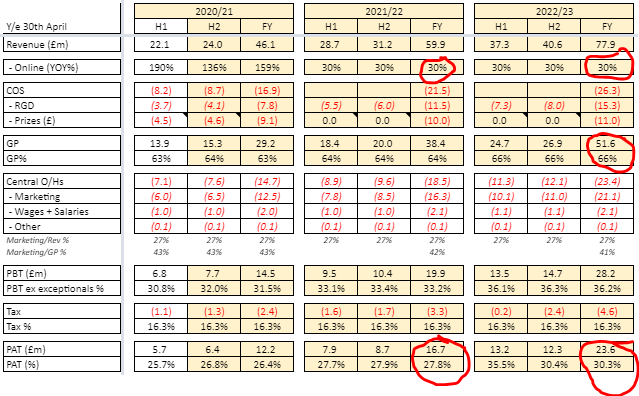

- I expect the Value of Prizes (COS-1) to increase by 40% in FY21.

I have worked this out based on:

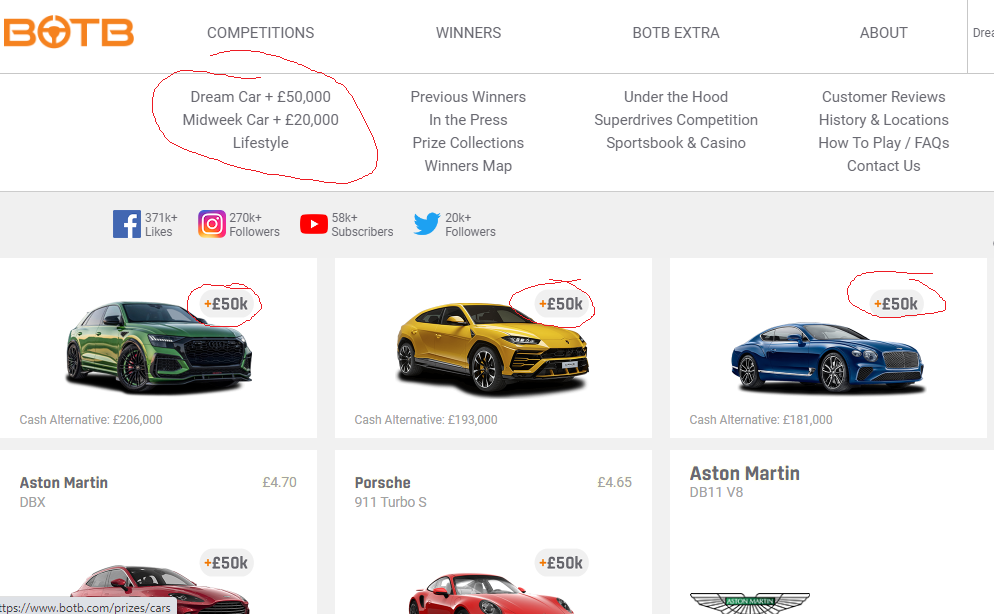

a) the average weekly value of the new Midweek prize (£39k so far), and

b) the average weekly value of the Dream Car + Lifestyle prizes (c.£90k since April 2019).

(NB: I know that the company generally does not receive discounts on car prizes.) - Remote Gambling Duty (COS-2) is relatively easy to estimate, though I believe it can't be worked out exactly as one needs to factor in free bonus credits plays, information which we don't have.

NB: I keep a running total of prize values, so my FY20 total COS figure was pretty accurate; I assume my COS forecasts below for FY21 and FY22 are therefore reasonable estimates. - I've been tracking Marketing costs since the last time these were announced back in FY17, and have assumed the 50% year-on-year increase this year continues for at least a couple of years.

- Salaries seem (unusually) constant at the moment.

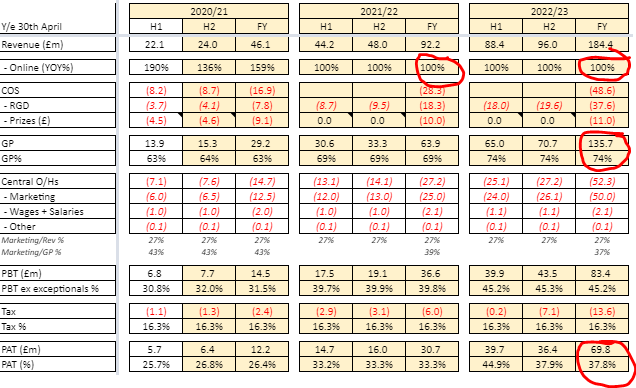

FORECASTING REVENUES FY21 AND FY22 - Version 1

- FY21 revenue growth of 55% (as guided by finncap)

- FY22 revenue growth of 30% (as guided by me)

Factoring all the above, FY21 and FY22 will generate PBT of £7.9m and £13.0m respectively.

VALUATION

I look at Best Of The Best (LON:BOTB) as a gambling company and therefore value it accordingly, with a slight caveat.

Online-only gambling companies that have been taken over in recent years have generally been valued at *10-12 EBITDA (I can't find out where I read this, but I keep this note with 888 Holdings (LON:888) , which I hold)

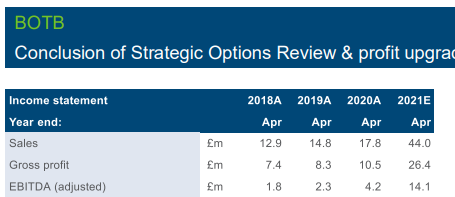

Given the highly leveraged operations and high growth rate of Best…