BGEO (LON:BGEO)

Share Price 2920p -186p (down 6%)

Bid/Offer 2918p - 2922p

Market Cap circa £1.2 billion NMS 500 shares

About the Company

BGEO group is involved in both the Banking and the Investment Business area.

The Banking business segment includes Retail/Corporate Banking, Investment Management, and Property & Casualty Insurance.

The investment side of the group includes Healthcare, Real Estate, Utility and a Beverage Businesses.

Profits are roughly split with 80% banking and 20% investment.

The company's 4 x 20 strategy below is to be achieved by allocating capital efficiently

- Return on Equity circa 20%

- Tier 1 Capital circa 20%

- Retail Loan Book Growth circa 20%

- Minimum Internal Rate of Return circa 20%

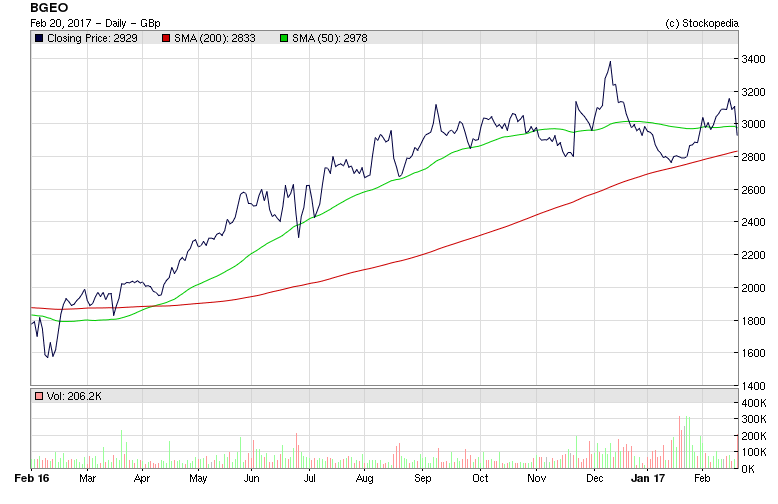

One Year Share Chart

Final Results Today

The 2016 earnings of 10.41(GEL) equates to circa 320p earnings per share. The results for the full year were somewhat flattered by once-off net exceptional gains over the year of stg19 million (45p eps). Initial stock market reaction saw the shares dropped by 10% in early morning trading. Late afternoon, the shares recovered and the overall drop was restricted to 6% at the close of trading. The forecast profits for 31 December 2017 are 12.1(GEL) which works out at circa 368p earnings per share.

The share price's initial fall today was based on the disappointment with the negative 4th quarter on 4th quarter comparisons. Today's RNS also mentioned the recent devaluation of the Georgian Lari by 13% in the final quarter versus the dollar. which added to their credit risk. The challenging macroeconomic conditions being experienced by BGEO may be a mild profit warning for 2017 expected growth in earnings.

Exchange Rates

Currently, one Georgian Lari (GEL) is equivalent to circa 32.8p sterling. Keep it simple for yourself and divide figures in GEL by three to get the approximate sterling conversion rate.

2016 Performance

During 2016, BGEO Group delivered a strong earnings performance against a challenging macroeconomic backdrop in a number of Georgia's regional trading partner countries which resulted in a year of lower economic growth than expected

Despite these challenges, Group revenue in 2016 increased by 17.8% to GEL 1.01 billion, profit increased by 37.8% to GEL 428.6 million, and earnings per share increased by 31.3% to GEL 10.41.

Full BGEO results available on http://www.investegate.co.uk/bgeo-group--bgeo-/rns...

Broker Forecasts December 2017 December 2018